The results of PrysmianGroup for the FY 2015 approved by the Board of Directors showed improved profitability and a better than- expected financial position.

The year has closed with better-than-expected results,” commented CEO Valerio Battista. He stressed that the company’s “ability to defend the more strategic, high value-added businesses continued to be decisive”. The market for submarine cables and systems has benefited the Group’s project execution capability, which has been further enhanced by investments in technological innovation, production capacity and in installation with the new cable-laying vessel Cable Enterprise.

In the Telecom business, the recovery of optical fibre competitiveness and the ability to develop innovative technological solutions for broadband allowed Prysmian to take full advantage of the opportunities in what is proving to be a solid market. The Group has also continued its commitment to containing costs and reorganising its manufacturing footprintCombined with careful financial management, this has

helped to ensure strong cash flows and a considerably better than expected net financial position.

Having achieved the original profit targets, the Board proposed a dividend in line with 2014 to the shareholders. In 2015, gross capital expenditure increased to €210 million and was aimed at highimpact projects (excluding acquisition cash out). Prysmian also invested €73 million in Research & Development. The process of regionalising structures in Europe progressed in 2015, with the aim of improving commercial synergies and the supply chain in an increasingly integrated market context, while the Group continued to devote even more attention to Corporate Social Responsibility.

Sales amounted to €7.361 million, posting organic growth of 5.3%, mainly thanks to the sharp growth in the Energy Project segment, and especially the Submarine and SURF businesses, while Underground High Voltage sales stabilised at 2014’s level. The Energy Products segment posted a slight recovery thanks to good progress in Energy & Infrastructure, resulting from a slight increase in Trade & Installers business and stronger growth in Power Distribution. This was partially offset by the decline of the Industrial cables business, which was hurt by the downturn in the Oil & Gas and Automotive businesses. Finally, the Telecom segment benefited from the continued growth in demand for optical cables and fibre worldwide.

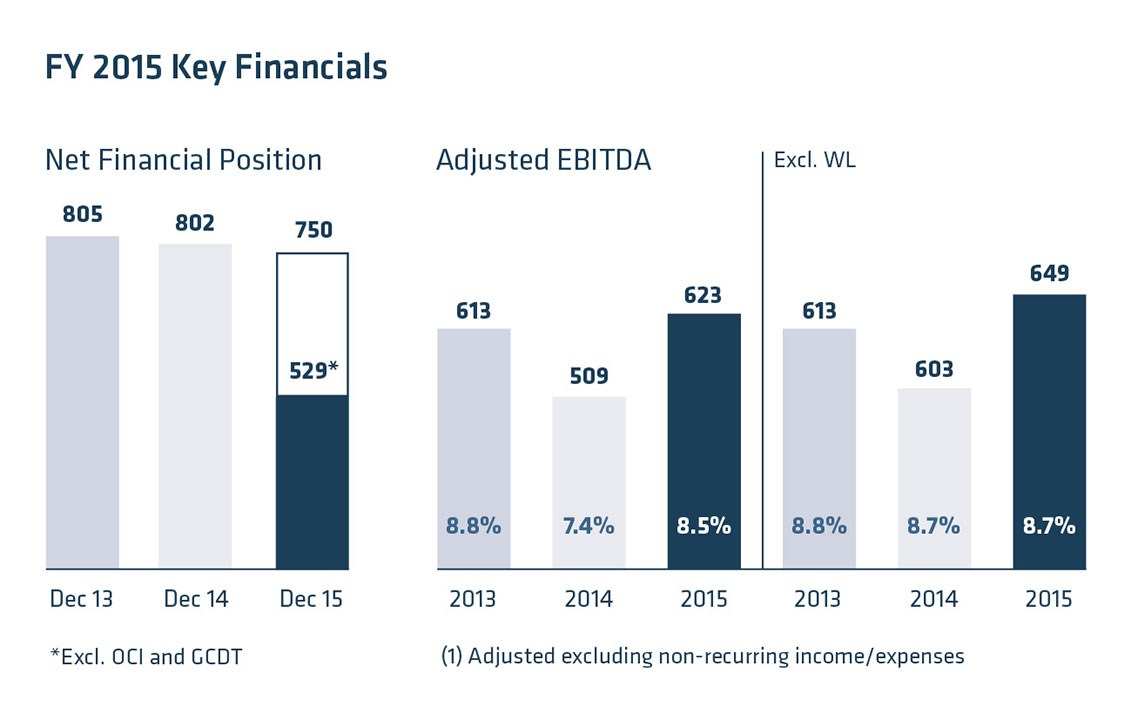

Adjusted EBITDA jumped 22.6% to €623 million, which, excluding the adverse impact of the Western Link project, would have been €649 million, versus €603 million in 2014. The improvement in profitability was steady throughout the year, particularly in the Energy Projects and Telecom segments.

The Group’s Net Financial Position improved to €750 million at the end of 2015, from €802 million one year earlier. Excluding the impact of two acquisitions which were finalised during the Q4 in 2015, the Net Finanical Position would have resulted in €529m, well below initial forecasts.

Net Profit amounted to €214 million, posting a sharp increase of 86.2% on €115 million recorded in 2014.

Excellent performances allround, with an increase in Submarine and SURF demand, and continued stability for our HV Cables division, despite volatile economic conditions.

Prysmian Group’s Energy Projects

operating segment saw sales reach €1.587 million in 2015 – an organic growth of 15 percent. Even taking on board the adverse impact of the Western Link project, profitability has been significantly higher, with Adjusted EBITDA at €246 million, (+59.7 percent on €154 million in 2014). If we exclude the Western Link numbers, this increase would be an impressive €272 million versus the €248 million of 2014.

Sales from Submarine Cables and Systems are very buoyant, particularly thanks to our ability to execute the numerous projects currently in the order book efficiently.

The Group has worked on completing major contracts, including the Italy-Montenegro, Dardanelles Strait and Greece-Cyclades interconnectors, connections for offshore wind farms such as BorWin3 and DolWin3 in Germany, and the ExxonMobil project in the United States.

We’ve worked hard to develop production process efficiency in order to accelerate the Western Link Project’s execution, reducing its negative impact by €30 million. The order backlog for Submarine Projects stood at €2.6 million at the end of 2015, with order intake exceeding €1 billion that year alone.

High Voltage Underground Systems has been generally stable compared with 2014, despite weak demand for new energy infrastructure in some European markets, and the geopolitical uncertainties in Russia. We’ve also witnessed stable performance in the two major markets of North America and China, with positive results in Britain and the Middle East.

Sales figures for our SURF division (products and services for offshore oil production) have been particularly strong thanks to high umbilical demand in Brazil, and orders in the region of €1 billion. We’ve also seen promising growth in our Down Hole Technology (DHT) business, which is benefitting from the Group’s expanded geographic presence and product portfolio.

We’re also confirming our commitment to developing this important valueadded market segment by completing the acquisition of Gulf Coast Down Hole Technologies in North America.

The Group’s Trade & Installers division posted a slight recovery throughout the year, and Power Distribution scored positively. Industrial & Network Components recorded a negative trend, mainly due to the sharp drop in O&G investments, and the automotive business downturn.

Overall sales from the Group’s Energy

Products operating segment have amounted to €4.665 million – a positive organic growth of 1.2% – due to volume recovery in Europe, North America, Oceania and Argentina. Adjusted EBITDA has risen by 2.1% to €243 million, from €239 million in 2014.

Energy & Infrastructure sales have risen organically by 3% to €2.795 million in a market still facing uncertainties in demand for energy and related infrastructure in parts of Europe, and marked by persistent difficulties in Brazil. Adjusted EBITDA came in at €128 million, having improved from €108 million in 2014.

Thanks to demand in North America, Britain, Northern Europe, Spain and some Asian markets, the Group’s Trade &

Installers business area witnessed static organic growth and stable prices, however, business decreased in South America, primarily due to the challenges in Brazil. The Group will continue to focus on large customers, while enhancing its range of high value-added products, such as fireresistant and LSOH cables.

Power Distribution recorded a positive sales performance, benefiting from the volume recovery in Northern Europe and strong demand in Germany, North America and Argentina. The Group has reinforced its commitment here to developing higher value-added products like P-Laser, which is gaining ever-increasing recognition from the utilities sector.

Industrial & Network Components sales amounted to €1.749 million, affected by the instability of demand in some sectors, but partly offset by the wide geographic spread and breadth of products and applications offered by the Group.

In the Oil & Gas division, the reduction in investments caused by falling oil prices has impacted the more capital-intensive business areas, such as Offshore and Maintenance, Repair and Operations.

Specialities & OEM posted good results for crane, railway and nuclear applications, particularly in North America and Europe, in contrast with rolling stock cables and marine applications.

The Renewables Energy division saw solar succeed in North America, while demand for onshore wind applications slowed in China and North Europe.

Elevators performed extremely well in nearly all geographic markets, particularly APAC and EMEA.

Network Components enjoyed strong sales in China and North America, but weaker demand for High Voltage in Europe. Adjusted EBITDA came in at €113 million as the downturn in The Group’s Oil & Gas division was partially offset by our other businesses.

This operating segment has seen growth in global demand for optical cables, sales volumes and profitability, with an additional upward trend in multimedia solutions.

The Group’s Telecom division posted a strong organic growth in sales, to €1,109 million – up by 9.9% on 2014 – and an Adjusted EBITDA increase of 14.9% to €134 million. These higher margins were achieved as a result of actions taken to rationalise the manufacturing footprint and regain fibre cost competitiveness.

Optical cables displayed a solid upward trend in demand in nearly all major markets, particularly North America, Europe and Australia. Prices have also stabilised after the pressures experienced throughout 2014. In Europe, the Group has won contracts for major projects to help establish backhaul links and FTTH connections for leading operators that include Orange and Free in France, and Telecom Italia in Italy. The development of ultra-broadband and FTTx networks in North America, providing 1 Gbps internet connection, has stimulated a continuous increase in demand. In contrast, investments continued to slow in Brazil, with a drop in order volumes.The Group maintains a constant focus on developing innovative solutions for ultrabroadband networks, such as the hybrid energy-telecom cable system, developed in at the end of 2015. Our high value-added Optical Connectivity business enjoyed a positive trend, thanks to the development of new FTTx networks (for last mile broadband access) in Europe and North America.

Multimedia Solutions also reported a positive trend, particularly in Europe, with the business’s recovery in earnings reflecting an improved product portfolio and costefficiency measures. The Group is now focused on developing higher value-added products, such as data centres, in Europe.

Positive comments from major brokers, and upbeat expectations for 2016 after Prysmian Group’s financial statements released for 2015. Amongst others, Citigroup stated its appreciation of the cashflow generation that has facilitated the reduction of the net financial position to €750 million, and Banca IMI have cited sound figures and satisfying expectations for 2016, keeping its target price at 22.50. Morgan Stanley put its target at 24.00, and despite a conservative outlook for 2016, displayed confidence by predicting a moderate growth and improved margins. Some brokers trimmed their targets but maintained a generally positive view. Akros have stated that results were very good, citing free cash flow; Equita are happy that 47% of the EBITDA projected for 2016 will be coming from resilient businesses such as Submarine and Telecom, with the earning per share expected to grow 7%, and Kepler Cheuvreux cut its earning estimates for 2016 to 2018 by 3%.