Growth gained steam in

Q3 Telecom on the rise

Quarterly Overview

Growth gained steam in Q3 Telecom on the rise

Profitability improved in high voltage underground, and there has been an uptrend for industrial and trade & installers. General Cable’s integration and synergies proceeding according to plan.

The Board of Directors of Prysmian Group has approved the consolidated results for the first nine months of the year. These results were ‘largely’ showing improvement, with a sound organic sales growth of 3.8%. Growth gained steam in Q3 and a 7.4% increase was reported. Chief Executive Officer Valerio Battista pointed out that the integration with General Cable, which began promptly after the closing of the acquisition, is proceeding according to plan, as the achievement of synergies is progressing in line with expectations.

In the energy projects business, the order intake for submarine cables is consistent with Prysmian’s market share, with the first part of the year marked by a slowdown in securing the award of some important projects and their postponement to the last part of the year or to 2019. In high voltage underground, the tendering process has begun for the large projects SüdLink and SüdOstLink in Germany, which represent important opportunities. The investment in the new cable-laying vessel for submarine cables has been confirmed, which will allow Prysmian to strengthen its leadership in terms of resources and assets.

The CEO also noted that in the telecom business, the Group is a strategic partner in several of the world’s biggest broadband projects. The market has responded well to innovative new businesses such as the monitoring of power grids using Pry-Cam technology and monitoring and maintenance services for submarine cables. 2018 profitability targets were confirmed, with fully-combined adjusted EBITDA in the range of €860 to €920 million.

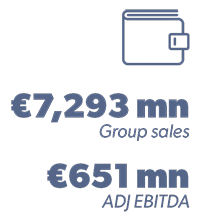

Sales

Sales amounted to €7,293 million, including €1,246 million generated by General Cable, chiefly driven by the optical cables business and connectivity systems for broadband telecommunication networks, as well as the uptrend in high voltage underground, industrial and T&I.

Adjusted EBITDA

Adjusted EBITDA came in at €651 million, of which €148 million was attributable to General Cable, compared to €714 million in 9M 2017 (€167 million from General Cable). This included a €25 million impact generated by reorganisation and efficiency improvement costs. The income is related to the listing of YOFC on the Shanghai stock exchange amounting to €36 million.

Net Financial Debt

The net financial debt amounted to €2,877 million as of 30 September 2018, compared to €436 million on 31 December 2017. The main factors that influenced the figure were the impact generated by the acquisition of General Cable, amounting to €2,599 million, positive operating cash flows of €403 million and an increase in net working capital amounting to €570 million, largely attributable to energy projects.

Guidance

The Group confirmed the forecast of a fully-combined adjusted EBITDA for the full year 2018 in the range from €860 million to €920 million, up from the €733 million reported in 2017.

Energy Projects

Organic growth up 6.4%

Stable profitability, net of the Western Link provisions, was accompanied by a decrease in the Group’s order book due to the postponement of some important projects. There is a stable market share and positive performances of high voltage underground in APAC, Southern Europe and South America.

Energy project sales (excluding General Cable perimeter) reached €1,086 million – a 6.4% organic growth. Adjusted EBITDA was €117 million, negatively impacted by the €70 million provisions related to the Western Link project, excluding which was equal to €187 million, up from €181 million in 9M 2017. Adjusted EBITDA ratio to sales went to 10.8% from 17.4%.

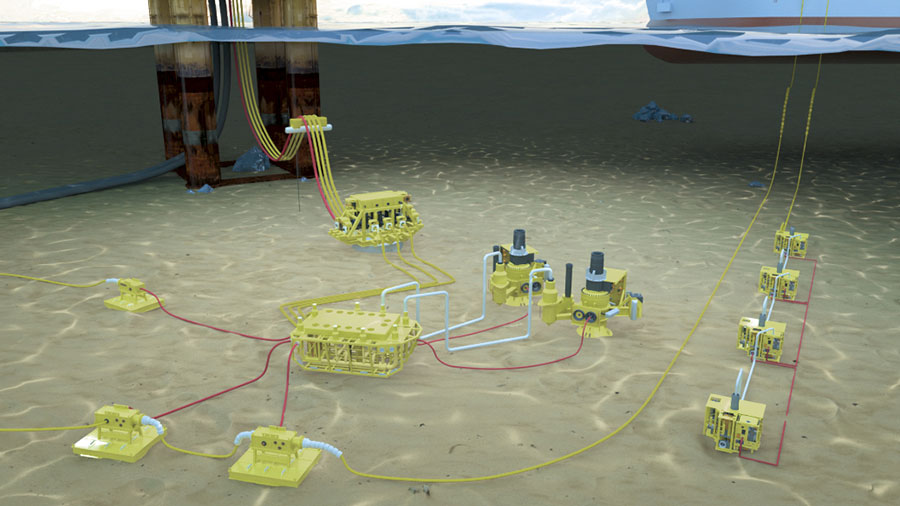

In the Submarine business, organic growth was affected by the impact of the Western Link project. The main projects for the period were the connections of the offshore wind farms Borwin3 and 50 Hertz, the NSL between Norway and Great Britain, the Cobra cable link between the Netherlands and Denmark, and the IFA2 interconnector between France and Great Britain. The completion of several inter-array connections, such as the Wikinger project, one of the most important offshore wind farms in the Baltic Sea, was also significant. Prysmian Group also confirmed an investment of about €170 million for building a new cable-laying vessel, which is expected to be operational by Q2 2021.

In the High Voltage Underground business, the positive results recorded in H1, driven mainly by growth in demand in APAC, Southern Europe and South America, were confirmed in Q3. The procurement process started for major interconnection projects in Germany such as SüdLink and SüdOstLink. The Group also recently secured new projects for a total value of approximately €80 million.

The power transmission order book totalled about €1,900 million, as the projects awarded were essentially consistent with Prysmian’s historical market share. It does not include two major contracts worth €220 million and €125 million, which have not yet received notice to proceed. Between August and October, the Group was awarded these two contracts for inter-array cables for two offshore wind farms, Fécamp and Courseulles-sur-Mer, and for the interconnection between the island of Crete and mainland Greece in the Peloponnese region.

Energy Products

T&I increased volumes

T&I reported growth in Europe and North America, as well as improvements in the Middle East. Power distribution is also positive. Industrial & NWC showed good organic growth and mixed improvement.

Energy Products sales amounted to €3,793 million, with a 2.6% organic growth, thanks to volumes increases in Europe and North America. Adjusted EBITDA came in at €180 million, down 7.1% compared to the same period of 2017, with a 4.7% ratio of adjusted EBITDA to sales from 5.3% one year earlier.

Energy & infrastructure sales amounted to €2,533 million, with 1.7% organic growth, while Adjusted EBITDA was €92 million from €107 million in 9M 2017 and a 3.6% ratio of adjusted EBITDA to sales compared to 4.3%.

The results in the trade & installers business showed a continued uptrend in Q3, thanks to the ongoing volume of growth in North America and Europe — particularly in Germany, Italy and Spain — and a trend improvement in the Middle East in Q3. Adjusted EBITDA benefitted from both the favourable sales mix following the new Construction Products Regulation coming into effect as well as the increase in sales volumes in Europe. Power distribution reported a positive sales trend in Q3 2018, particularly in France and Germany, while weakness was reported in Northern Europe.

Industrial & network components sales grew organically by a sharp 4.9%, reaching €1,146 million, while the adjusted EBITDA was €88 million, in line with 2017, with a 7.6% ratio on sales. The specialties, OEMs & renewables market recorded an organic growth of sales, with a good performance of railways, rolling stock and crane applications and a recovery of mining and renewables. The growth, recorded in all geographical areas, was mainly driven by the Americas and APAC area. Growth was also confirmed for elevators in Q3, supported by the favourable market conditions in North America. The sales uptrend of the automotive business was driven by growth in North America and South America, whereas the APAC area reported a slowdown. Network components demonstrated solid performance, supported by the volumes in China and North America.

Oil & Gas

In line with 9M 2017

In the core cables oil & gas business, demand for onshore projects market remained constant. Profitability was also stable, despite the reduction in volumes of the offshore.

Oil & gas sales amounted to €194 million, excluding the General Cable perimeter, virtually in line with the figure of 9M 2017 with a 0.4% negative organic change compared to 9M in 2017. Adjusted EBITDA in 9M 2018 amounted to €2 million compared to €5 million in 9M 2017, with a 1.3% ratio to sales from 2.3% in 9M 2017.

In the SURF (Subsea Umbilicals, Risers and Flowlines) business, the market of umbilical cables shrank in Brazil and profitability declined due to increased competitiveness. Demand improved nevertheless in the downhole technology business, compared to the same period of 2017, benefitting from the production increase of shale oil & gas in North America.

Telecom

Sharp sales uptrend

There was a sharp uptrend in sales thanks to acceleration in Q3 in Europe and Latin America. Profitability increased thanks to the growth in volume, efficiencies and optimisation of manufacturing set-up solid MMS performance thanks to European demand for data centres and data cables.

Telecom sales, excluding GC perimeter, grew organically by 6.5% to €974 million, driven by the Q3 trend improvement in Europe and Latin America. Adjusted EBITDA climbed to €204 million compared to €167 million while margins also improved with a 20.9% ratio of adjusted EBITDA to sales from 17.6% in 9M 2017, benefitting from the increase in volumes, the recovery of industrial efficiencies and the positive results of the subsidiary YOFC in China.

Organic growth of sales of the telecom solutions business was due to the ability to seize the ongoing growth of demand for optical cables by operators developing broadband networks. In Europe, the volume trend was positive. In North America, the development of a new ultra-broadband network is generating a constant rise in demand, which benefits Prysmian, as testified by the $300 million signed with Verizon for the supply of optical cables. Brazil and Argentina also showed increased investments by their main telecom operators. In Australia, works to the construction of NBN’s new “multi-technology” platform continued successfully.

The high value-added business of optical connectivity accessories continued to perform well, thanks to the development of new FTTx networks in Europe, particularly in France. Multimedia solutions showed a solid performance, particularly in Europe, where demand was also driven by the growing investments in data centres.

Higher demand seen for cyclical businesses

In the submarine business, despite the slowdown in order flow in the first half, Prysmian aims to maintain its leading position, partly as a result of the expected increase of projects awarded in the final part of the year.

Global economic growth remained positive in the first nine months of 2018, with a sharp acceleration in the US economy driven by rising domestic consumption and investments, whereas China continued to display the positive trend that they had been experiencing since the beginning of the year. Growth in Europe, while still positive, started to slow in the second half.

Within this context, Prysmian Group expects demand in the cyclical construction and industrial cable businesses to be higher than in 2017, driven by Europe and partially offset by the Middle East, with uneven performances in the other geographical areas. In the submarine business, despite the slowdown in order flow in the first half, Prysmian aims to maintain its leading position, also in light of the expected increase in the volume of projects awarded in the final part of the year. In the high voltage underground business, a recovery on 2017 is expected, with a gradual improvement in China and South-East Asia. The telecom segment growth is expected to stay solid in 2018, driven by increased demand for optical cables in Europe and North America, whereas copper cables are slowing due to reduced demand from Australia.

In light of these considerations, the Group expects an adjusted EBITDA for FY 2018 in the range of €860-920 million, inclusive of the recently acquired General Cable business for all of 2018. The forecast also takes into account the negative impact of exchange rate trends of approximately €30 million and the provision of €70 million already recognised in H1 2018 deriving from the costs associated with the delays in the Western Link project.