Profitability stays high

in the first nine months

Quarterly overview

Profitability stays high in the first nine months

Adjusted EBITDA up 3.3% to €545 million with a major improvement in margins for strategic businesses of Energy Projects and Telecom.

The Board of Directors of Prysmian Group has approved the results for the first nine months of 2017, which display an improvement in profitability despite broadly stable revenues, showing signs of some upward movement in the third quarter.

Commenting on these results, CEO Valerio Battista noted in particular that “we’re seeing significant growth in volumes and margins for Telecom, driven by rising demand for optical cables, and improving margins for Energy Projects thanks to progressive in-sourcing of submarine cable installation services”. The CEO pointed out that cable technology is demonstrating it can make a significant contribution to digitalisation projects, with the development of new broadband networks, and to the use of renewable energy sources, by helping make businesses like offshore wind farms more and more competitive.

The market scenario in which the Group operates, Mr. Battista remarked, “offers good opportunities that we intend to pursue by focusing on product and service innovation”. Despite the negative impact of results reported by the subsidiary Oman Cable Industries and of adverse exchange rate movements, Prysmian has confirmed the full year 2017 earnings guidance already communicated to the market of an Adjusted EBITDA in therange of €710 million - €750 million.

Sales

amounted to €5,865 million in the first nine months declining organically by 1.1%, but with the negative gap narrowing in the third quarter to -0.4% thanks to further revenue acceleration in Telecom’s optical business and to a recovery in Trade & Installers.

Adjusted EBITDA

climbed 3.3% to €545 million with a margin on sales of 9.3%, stable compared with the first nine months of 2016 but with a marked improvement in profitability by the strategic businesses of Telecom and Energy Projects. This has absorbed not only the effects of less upbeat earnings performance by other businesses and the subsidiary Oman Cable Industries, but also the adverse impacts of exchange rates.

Net Financial Debt

amounted to €1,052 million at 30 September 2017 compared with €1,017 million a year earlier, having made €100 million in share buybacks since January. The principal factors influencing Net Financial Debt in the past 12 months have been: €617 million in net cash flow provided by operating activities before changes in net working capital, €99 million in cash used by increased net working capital, €101 million in tax payments, €239 million in net operating capital expenditure in the past 12 months, including €46 million to acquire the High Voltage assets in China.

Guidance

for full year 2017 is confirmed with an Adjusted EBITDA in the range of €710-€750 million, up from €711 million reported last year.

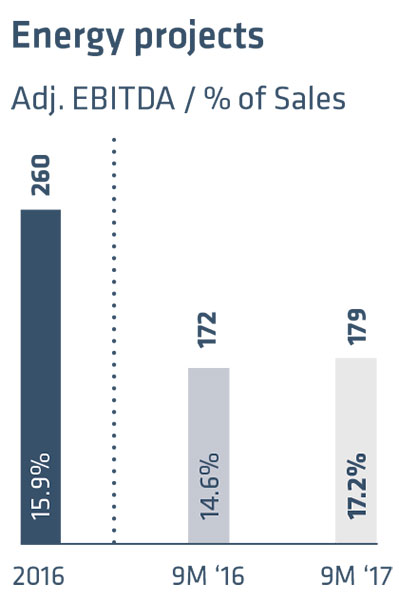

Energy Projects

Growth in submarine business profitability

In the first nine months, Adjusted EBITDA climbed 4.1% to €179 million with a margin on sales up to 17.2% from 14.6% in the same period of 2016.

Prysmian Group Energy Projects Operating Segment posted sales of €1,039 million, down organically by 6.7% after postponing installation milestones due to rough weather in the North Sea. 3rd-quarter stabilisation for HV underground.

In the Submarine Cables and Systems the strategy of in-sourcing part of its installation activities, combined with a favourable execution mix, helped boost profitability. Business prospects are encouraging, especially in the increasingly competitive offshore wind farm business, also thanks to advances in the technological solutions offered by the cable industry, with higher voltage cables supporting larger turbines.

Growth prospects for submarine cables are supported by the much greater competitiveness of offshore wind power generation, measured by the reduction in the so-called Levelized Revenues of Energy (LRoE), featuring in the award of recent tenders in Germany.

Sales of High Voltage Underground were affected by flagging demand in France, Northern Europe and the United States, only partly mitigated by growth in the Asia Pacific region. The business has witnessed a progressive stabilisation over the course of the year. Profitability was affected by the change in the Group’s perimeter in China, only partially tempered by positive performance in Asia Pacific.

The underground and submarine power transmission order book at the end of September 2017 stood at €2,500 million, slightly higher than in December 2016.

Energy Products

T&I also helped by CPR

But the Middle East posted a negative performance due to weak regional economy while Industrial & NWC improved organically, although the business mix was still weaker than a year earlier.

Sales amounted to €3,672 million, largely in line with the first nine months of 2016. Adjusted EBITDA came in at €194 million with a 5.3% margin on sales from 6.4% in the first nine months of 2016.

Energy & Infrastructure amounted to €2,467 million, down 1.2%, with Adjusted EBITDA at €107 and margin on sales at 4.3% versus 5.4% in the same period of 2016. The decline was largely due to negative performance in the Middle East. Trade & Installers showed a recovering trend in Europe, after a weak start to the year, with much of the momentum coming from the Netherlands, Italy, Spain and the Nordics, demonstrating how the Group is making the most out of the new Construction Products Regulation, which has dictated a rise in quality standards. Performance was also positive in Asia Pacific, while less encouraging in the Middle East affected by economic downturn. Power Distribution reported a slight fall in sales, due to the anticipated market slowdown in Central and Eastern Europe. Positive performances were recorded in the Nordics, USA and Asia Pacific.

Sales of Industrial & Network Components rose 2.2% to €1,100 million, confirming the positive trend by some OEM niches and Automotive, while Adjusted EBITDA came in at €88 million with margin on sales down to 8.0% (from 9.3%), basically due to an unfavourable mix of applications.

Specialties, OEMs & Renewables enjoyed positive organic sales growth, fuelled by APAC, North America and Turkey. Railway posted good volumes and Infrastructure turned in a solid performance, helped by robust order intake. Mining continued to recover while Crane, Marine and Defence were still weak after peaking in 2016. Margins were nevertheless squeezed due to an unfavourable mix of business. Elevators did well in Europe but sales continued contracting in China, which negatively impacted profitability. Automotive enjoyed further double-digit sales growth in the third quarter, thanks to growth in Asia Pacific, North and Latin America, with profitability also improved. The Network Components business recorded a slight increase in third-quarter volumes, despite continuing signs of HV slowdown in China, France and the Netherlands. Medium and low voltage performed well in Europe and the United States.

Oil & Gas

Positive performance by Core Cable

But Surf was still affected by soft demand in Brazil. DHT saw an onshore recovery, but the offshore market was still weak.

In the first nine months sales fell organically by 13% to €201 million, a slight improvement from the -14.8% reported in the first half. Adjusted EBITDA was €5 million, down from €9 million in the same period of 2016, with a margin on sales of 2.3% versus 4.1% in 2016.

In the third quarter the Core Cables Oil & Gas business accelerated the positive performance seen in the first half of the year, particularly driven by onshore projects in North America and the Middle East, while offshore remained weak.

The recovery in volumes along with the efficiencies achieved have supported profitability.

The business of Subsea Umbilicals, Risers and Flowlines continued to be affected by challenging market conditions in Brazil, that impacted both volumes and margins. The Downhole Technology business saw onshore volumes recovering in the USA thanks to the shale oil market, contrasting with generally soft demand in the offshore and international markets.

Telecom:

further leap in profitability

Sales up 5.9% organically with optical cables confirming double-digit growth in the third quarter. Adjusted EBITDA continued to forge ahead.

Sales grew 5.9% organically to €953 million in the first nine months with optical cables confirming their double-digit pace of growth in the third quarter, despite the challenging basis of comparison with the same period of 2016 and the anticipated decline in copper cables, primarily on the Australian market. Adjusted EBITDA climbed 30.3% year on year to €167 million, with margin on sales also improving to 17.6% from 14.9% one year earlier.

The positive results benefited not only from increased volumes but also from investments to optimise the manufacturing footprint, from efficiency gains in optical fibres and improved results by the subsidiary YOFC.

Growth in Europe has proven solid, with major projects to develop broadband networks in France, such as the Trés Haut Débit project, and Italy, where Prysmian has secured orders for optical fibre cables both from the TIM incumbent and the government plan being implemented by Open Fiber. There has also been a steady growth in demand in the U.S. thanks to investments to upgrade the fixed and mobile networks in preparation for 5G technology.

The market for copper cables has been weak, while the high value-added business of optical connectivity accessories performed well, thanks to the development of new FTTx networks for last mile broadband access in Europe, namely in France and Britain. The Group continues to invest to boost production capacity for both optical cables and fibres to support medium-term growth prospects of the business.

THE MARKET REACTION

Market reactions to the 9M 2017 results were moderately positive, with numbers substantially in line with expectations supported by solid margin growth in Energy Projects and Telecom segments offsetting the negative impact from OCI underperformance and adverse forex effects. Organic growth was slightly below market expectations mainly due to lower-than-expected Energy Projects sales connected to harsh weather condition in the North Sea.

Following the results, several brokers and investment banks have adjusted their Target Price for Prysmian shares, with just one broker (Banca AKROS) switching its recommendation to “NEUTRAL”. In particular, Credit Suisse and Morgan Stanley confirmed the positive recommendation adding further upside to their current target price valuation now seen at 30 €/share. JP Morgan and Bank of America-Merril Lynch confirmed their positive view of Prysmian thanks to the upbeat expectations for 2018. Among the more prudent views were Equita and Fidentiis, which reiterated their “NEUTRAL” rating considering M&A as the only catalyst for a further re-rating of the stock after the recent rally.

Submarine and Telecom to lead growth

The Group expects marginally higher demand for building cables and overall improvement for Industrials. Slight downturn seen for HV underground.

The global economy has steadily improved in 2017, with consumer and business confidence improving in many areas and better-than-expected GDP figures in both developed and major developing economies. The U.S. improved after a disappointing start to the year, while China has maintained a robust pace of growth throughout the year.

In such a context, Prysmian forecasts for FY 2017 that demand in the cyclical business of building wires will be marginally higher than in 2016, while that for medium voltage cables for utilities will be slightly down. The Industrial business is forecast to make an overall improvement, thanks to growth prospects for some OEM applications and Automotive. With Energy Projects seeing a slight growth in market, the Group anticipates consolidating its leadership in Submarine cables and systems while boosting

profitability through the in-sourcing installation activities. HV underground is expected to record a slight downturn partly due to the change in the scope of consolidation after reorganising the manufacturing footprint in China. In the Oil & Gas the stabilisation of the oil price is underpinning resumed demand for Onshore projects, primarily in North America and the Middle East, while the Offshore business remains weak, with the SURF business being affected by soft demand in Brazil. The Telecom segment is forecast to record strong sales growth for 2017, reflecting growing demand for optical cables in North America and Europe, tempered by the expected slowdown in copper cable demand in Australia.

The Group has confirmed its forecast of Adjusted EBITDA for FY 2017 in the range of €710-€750 million, up from the €711 million reported in 2016, based on the Company’s current business perimeter and taking into account the existing order book.