H1 2017 results:

moving in the right direction

Quarterly overview

H1 2017 results: moving in the right direction

Results for first half of 2017, approved by Prysmian’s Board of Directors, also showed an uptick of sales in Q2. Sound order book.

The first half of year 2017 has seen a sharp increase in profitability, with improving margins in the strategic Energy Projects and Telecom businesses. CEO Valerio Battista explained that sales have posted a marked improvement in the second quarter after a poor start of the year, due to adverse phasing in the Energy Projects business. The Group’s profitability has indeed continued to grow, thanks to the contribution of the Telecom and Energy Projects businesses. The Industrial business has also enjoyed a positive trend, with an order backlog providing a strong outlook for the remaining of the year. Major projects were awarded, not only in the Energy Projects business for the IFA2 interconnector and new offshore wind farm cabling in France, but also in the Telecom business, with the $300 million Verizon agreement. This validated and rewarded the Group’s investment strategy aimed at building up submarine project execution capabilities and optical fibre and optical cable production capacity. The FY 2017 outlook is confirmed, with a target in terms of Adjusted EBITDA in the range of €710-€750 million, increasing from €711m reported in FY2016.

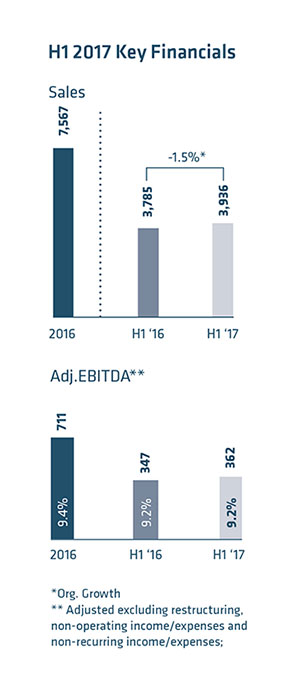

Sales

amounted to €3,936 million, displaying a second-quarter recovery with organic growth of 0.6% thanks to recovery of the phasing in the Energy Projects and to an improvement for Industrial & Network Components. Six-month organic sales retreated by 1.5%.

Adjusted EBITDA

climbed 4.3% on the first half of 2016 to €362 million with a marked improvement in profitability inthe Energy Projects segment with Adjusted EBITDA margin at 17.0% versus 14.6%. Margins were also up in the Telecom segment thanks to growth in volumes and the effects of investments in fibre manufacturing efficiency.

Net Financial Debt

amounted to €1,000 million at 30 June 2017, improved from €1,031 million one year earlier, also including €99 million for shares buyback since January.

The principal factors influencing Net Financial Debt in the past 12 months have been: -€636 million in net cash flow provided by operating activities before changes in net working capital; -€237 million in net operating capital expenditure in the past 12 months, including €46 million to acquire the High Voltage assets in China; -€99 million to buy back the Company’s shares.

Guidance

for full year 2017 is confirmed for an Adjusted EBITDA in the range of €710-€750 million, up from €711 million reported last year.

Energy Projects

Profitability well up

In the first half Adjusted EBITDA rose 4.6% to €116 million with margin on sales at 17.0% from 14.6%. Organic growth improved considerably in the second quarter.

Prysmian Group Energy Projects Operating Segment posted sales of €685 million with organic growth improved in the second quarter after a negative start to the year due to unfavorable phasing.

Sales of Submarine Cables and Systems increased in the second quarter, recovering a good part of the ground lost at the start of the year, while profitability improved significantly, having also benefited from investments in new installation assets like the “Ulisse” cable-laying vessel and the new jetting system, which allowed a large portion of high-margin activities to be performed in-house. Major growth opportunities are seen in the offshore wind farm market, where the Group can offer a competitive range of technologies and turnkey services, from project engineering and management to design and production of innovative cable solutions, up to system installation, monitoring and maintenance. Growth prospects for submarine cables are supported by the much greater competitiveness of offshore wind power generation, measured by the reduction in the so-called Levelized Revenues of Energy (LRoE), featuring in the award of recent tenders in Germany.

Sales of High Voltage Underground were affected by weak demand in France, Middle East and the United States, despite benefiting from solid performance in Asia Pacific thanks to strong order intake in the second quarter. Results were also affected by the change in the Group’s perimeter in China.

The underground and submarine power transmission order book currently stands at €2,450 million, thanks to important new projects secured in the past few months, amongst which the IFA2 interconnector between France and the UK.

A mixed bag for

Energy Products

Positive organic performance for Industrial & Network Components business, mainly driven by Specialties & OEMs and Automotive niches. Negative trend in E&I impacted by weak performance in Oman and slowdown in Central-East Europe for Power Distribution cables.

Overall sales of Energy Products declined slightly organically to €2,467 million, particularly because of the contraction in cyclical business in Europe, only partially offset by positive performance of certain applications in the industrial cables. Adjusted EBITDA was €135 million in the first half with a 5.5% margin on sales from 6.6% in the same half of 2016.

Energy & Infrastructure posted sales of €1,658 million, with Adjusted EBITDA at €74 million with margin on sales at 4.5% versus 5.5%, a decline largely due to the drop in volumes in Oman. Trade & Installers had mixed results, with positive performances in North Europe, Oceania and China and weakness in Oman, Turkey and Argentina. North America’s renewable energy policies also had a negative impact. The implementation of the Construction Products Regulation in Europe will lead to higher quality standards and represents an opportunity for the Group.

Power Distribution performed well in Asia Pacific, North Europe and North America, while the slowdown in Germany and Eastern Europe was in line with expectations. Challenging market conditions in Central and Eastern Europe and Oman adversely affected profitability.

Sales of Industrial & Network Components increased 2.5% to €739 million, a sharp improvement after the decline at the start of the year, driven by solid performance in the OEMs and Automotive markets. Adjusted EBITDA was largely stable at €62 million.

Specialties, OEMs & Renewables enjoyed slightly positive organic sales growth, with solid performances by Railway and Infrastructure and a recovery by Mining and Renewables. Crane, Marine and Defence were still weak after peaking in 2016. The strengthening of the order book provides a positive outlook for the rest of the year. Sales of Automotive business were also solid during H1, mainly driven by growing demand in APAC and North America; margins were also good in H1. Elevator business recovered in Q2 after a soft start of the year, thanks to a positive trend in Europe partially offsetting negative APAC evolution. Finally, the Newtwork Component business suffered from the reduction of volumes for High Voltage accessories, only partially offset by the good trend in Medium and Low Voltage business in Europe and US.

The worst seems to be over for

Oil & Gas

Core cable volumes up, thanks to recovery in onshore projects with good trend in profitability, still weak performance by umbilicals due to tough market in Brazil, DHT saw good onshore demand in US.

In the first half sales went down organically by 14.8% but the second quarter figures indicate that the worst seems to be over with the contraction halved to 7.6% from 21.2% in the first. Adjusted EBITDA was €2 million in the first six months with a margin on sales of 1.1%.

The Core Cables Oil & Gas business recorded a positive performance with growth in sales, particularly in connection with onshore projects in North America, Russia and Middle East. The recovery in volumes along with the efficiencies achieved have supported profitability even in a difficult situation with prices under pressure due to weak demand.

The SURF business (Subsea Umbilicals Risers and Flowlines) has been affected by the steep downturn in the umbilicals market in Brazil, after a slump in new project awards in 2016. The Downhole Technology business saw onshore volumes recover in the USA thanks to the shale oil market, contrasting with generally weak demand in other markets, and margins under pressure due to the unfavourable product mix.

Telecom:

solid sales organic growth

Sales up 7.5% organically driven by demand for optical cables. Three-year, €250 million investment plan launched in optical fibre and cables. Growth in volumes and margins for Multimedia Solutions.

Sales amounted to €646 million mainly thanks to constant growth in demand for opticals driven by major investment projects in Europe and North America. Adjusted EBITDA up 38.6% to €109 million while margin on sales improved to 16.8% from 13.7%.

The Telecom Solutions business won important contracts with leading operators in Europe for the construction of backhaul links and FTTH connections. In North America, the development of new ultra-broadband networks is generating a steady increase in demand from which Prysmian is benefiting, as evidenced by the three-year $300 million agreement with Verizon to supply optical fibre cable from January 2018. The Group has embarked on a three-year €250 million investment plan to boost production capacity and efficiency. The high value-added business of optical connectivity also confirmed positive results, driven by the development of new FTTx networks in Europe.

Multimedia Solutions recorded higher volumes and improved margins in Europe and Asia Pacific, partly thanks to the improvement in the industrial set-up in Europe. Demand is being particularly driven by growing investments in Data centres.

THE MARKET APPRECIATED

Market reaction after H1 2017 results were positive, as figures came 2%/5% above expectations thanks to a better than expected performance in Energy Projects and Indsutrial&Network Comp. segments, and sharp increase in Telecom margins, partially offset by a weaker than expected performance in E&I segment.

Following the positive results, several brokers increased their Target Price valuation on Prysmian shares, including one upgrade of recommendation (Banca IMI, from HOLD to ADD, Target Price to 29.9 from 26.0 €/share). More in detail, GoldmanSachs confirmed the BUY recommendation taking its target price valuation to 32 €/share from 31 €/share after increasing estimates on 2018 and 2019 results; Morgan Stanley, JP Morgan and Bank of America – Marril Lynch all confirmed their positive view on Prysmian taking their Target Price valuation to 29.0 €/share. Equita and Kepler reiterated their “NEUTRAL” stance, both adjusting their Target Price to 27.5 €/share after better than expected results and possible sector consolidation seen in the coming 6-12 months.

Upbeat targets for FY 2017 confirmed

The Group expects stable demand for buildings and utilities with Energy Projects enjoying a growing market mainly in the Submarines.

Global economic growth in the first half of 2017 was higher than expected thanks to the emerging countries and the consolidation of the positive trend by the more developed economies. After an uncertain start marked by lower-than-expected growth, positive jobs data in the US indicate a clear recovery since the second quarter, when China too recorded improved growth.

In such a context, Prysmian expects for FY 2017 a largely stable cable demand in the cyclical businesses of building wires and medium voltage cables for utilities. Various applications in the industrial business will have a mixed but positive performance thanks to an uptick in the Automotive and OEM markets. With Energy Projects enjoying a growing market, the Group expects to consolidate its leadership while further improving profitability in the Submarine business, while a slight decline is seen in the High Voltage underground business, partly due to the change in the scope of consolidation in China. In the Oil & Gas, the stabilisation of the oil price in the region of $40-50 is underpinning a resumption of onshore projects, while offshore activities remain weak, like the SURF business. In the Telecom segment, the underlying growth is expected to remain strong in 2017, thanks to growing demand for optical cables in North America and Europe, accompanied by a gradual volumes stabilisation in Australia.

Assuming stable exchange rates, the effect of translating the results into the reporting currency is expected to have a mildly negative impact on 2017 operating income.

The Group confirms the forecast of Adjusted EBITDA for FY 2017 in the range of €710-750 million, up from €711 million reported in 2016. The forecast is not only based on the Company’s current business perimeter but also takes into account the order book.