Return to Revenue Growth

in the First Quarter

Quarterly overview

Return to Revenue Growth in the First Quarter

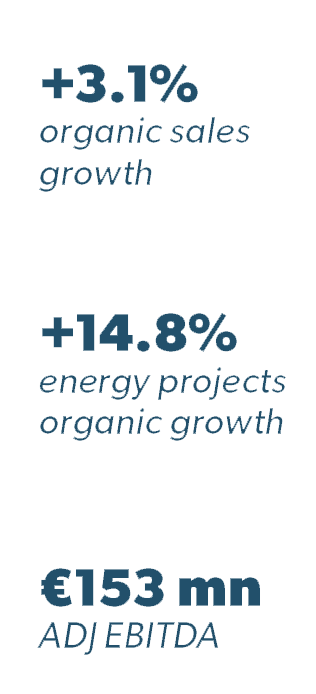

Organic sales grew by +3.1% with a strong boost from High Voltage Underground and Industrial, accompanied by solid growth in optical cables and a positive trend in Trade & Installers. Profitability was stable.

The Board of Directors of Prysmian Group has approved the consolidated results for the first quarter of 2018, marking a more decided return to revenue growth. This was partly due to the favourable phasing of submarine project execution activities, strong demand in the High Voltage Underground business, and growth in the Industrial Business. At the same time, the positive trend for telecom has been confirmed, with demand for optical cables growing worldwide.

Valerio Battista, CEO of Prysmian Group, noted that “market prospects are essentially positive for the Group's two strategic segments: submarine cables and systems, where we expect tendering activities to intensify in the second half; and telecom, where demand for optical cables serving new broadband networks continues to be high, especially in France with the Très Haut Débit project”.

Sales

Sales amounted to €1,879 million, up 3.1%. Energy Projects recorded organic growth of 14.8%, while Telecom also performed well. Within Energy Products, the industrial and network components business posted a significant growth in sales.

Adjusted EBITDA

EBITDA came in at €153 million, in line with the corresponding first quarter figure. Margin on sales was also stable at 8.1%. The resilience of profitability was supported by the significant growth of telecom and affected by negative Forex effects of €13 million.

Net Financial Debt

Net financial debt improved, reaching €648 million as of 31 March 2018 from €998 million one year earlier, having benefited from €291 million for conversion of the convertible bond in 2013. Net cash flow over the past 12 months was €257 million. The principal factors influencing the change were €616 million in net cash flow provided by operating activities, €40 million in cash flow provided by the decrease in net working capital, and €233 million in net operating capital expenditure over the past 12 months.

Guidance

The consolidated ADJ EBITDA - which now includes General Cable Corporation and controlled companies - is expected to fall somewhere between €860 million and €920 million for 2018.

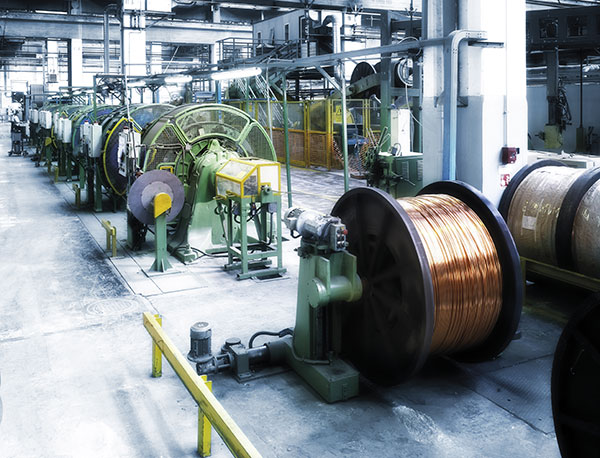

Energy Projects

Sales bouncing back strongly

Revenues posted organic growth of 14.8%.Intense tendering activity is expected in second half of year.

Energy Projects sales reached €311 million, posting organic growth of 14.8% with adjusted EBITDA at €21 million versus €40 million in the same period of 2017, and margin on sales at 6.9%, down from 14.4%, having absorbed €20 million provision.

Submarine Cables and Systems posted a positive sales performance thanks to positive phasing of project execution – also enabled by the Group's investment in innovative assets – allowing it to improve its installation capabilities. Of particular note in the first three months was the award of the first ever cable contract for a floating offshore wind farm, the Kincardine in Scotland, for which the Group will also supply the inter-array cables, along with the award of a contract by Terna Rete Italia S.p.A. for a submarine power cable between Capri and Sorrento.

The total value of the submarine cables and systems order book stood at around €1.9 billion, while tendering activity is expected to intensify in the second half of the year.

High Voltage Underground organic sales growth benefited from robust demand in some Asian markets, including Indonesia, as well as in France, Spain and Turkey. Profitability was affected by the mix of sales, significantly up in more competitive markets. The Group's order book for high voltage underground cables stood at around €450 million, with a positive outlook thanks to strong performance in the Middle East and Asia Pacific markets.

Energy Products

Growth for Prysmian’s Industrial Business

Trade & Installers posted recovery, while power distribution was weak, especially in certain regions. Profitability was affected by a hike in metal prices for power distribution and a drop-in volumes and margins for Oman Cables Industry.

Energy Products sales grew organically by 1.4% to €1,194 million, largely due to a recovery in volumes in Europe, with adjusted EBITDA at €58 million from €61 million in Q1 2017, with a slight fall in margins due to the hike in metal prices for power distribution and drop in margins for Oman Cables Industry.

Energy and Infrastructure sales amounted to €790 million while adjusted EBITDA came in at €31 million.

Trade & Installers recorded an upturn in demand translating into a growth in sales, predominantly in Southern Europe, Germany, Eastern Europe and the Netherlands, also thanks to the implementation of the new Construction Products Regulation. The subsidiary Oman Cables Industry performed poorly, reflecting conditions on the local market, but overall business profitability improved.

Power Distribution reported flagging sales volumes, particularly in South America, Northern Europe, Southeast Asia and the Middle East, also adversely affecting profitability. Germany and the Netherlands showed a slight recovery.

Industrial and Network Components posted a significant sales improvement of 10.7% to €369 million, while adjusted EBITDA was in line at €27 million.

Specialties and OEM turned in a strong performance with double-digit organic growth, predominantly driven by railways and infrastructure. Renewables were stable, while crane and nuclear both underperformed. Organic sales growth by the elevators business was largely the result of growing demand in the EMEA region. Organic growth and higher profitability marked the automotive business, thanks to solid performance in North America, South America and Europe.

Oil & Gas

Core shows demand upturn Signs

Oil & Gas sales came in at €57 million, down organically 9.1%, while adjusted EBITDA was a negative €1 million. Volumes and price pressure somewhat eased for umbilicals, while there were positive signs for downhole technology thanks to shale oil.

The subsea umbilicals risers and flowlines business was affected by price pressure and reductions in umbilical projects, resulting in a significant shrinkage in sales and margins. In the downhole technology business, demand showed signs of improving with an upturn in volumes thanks to the dynamism of shale oil in the USA and a recovery in demand in the Middle East, while the offshore market has remained weak. Driven by onshore projects, the core Oil & Gas business recorded signs of reviving demand with a recovery in profitability, thanks to the Group's focus on design-to-cost and actions in the supply chain to offset the impact of lower prices. Volumes were once again down in the higher margin offshore and Maintenance, Repair and Overhaul sector.

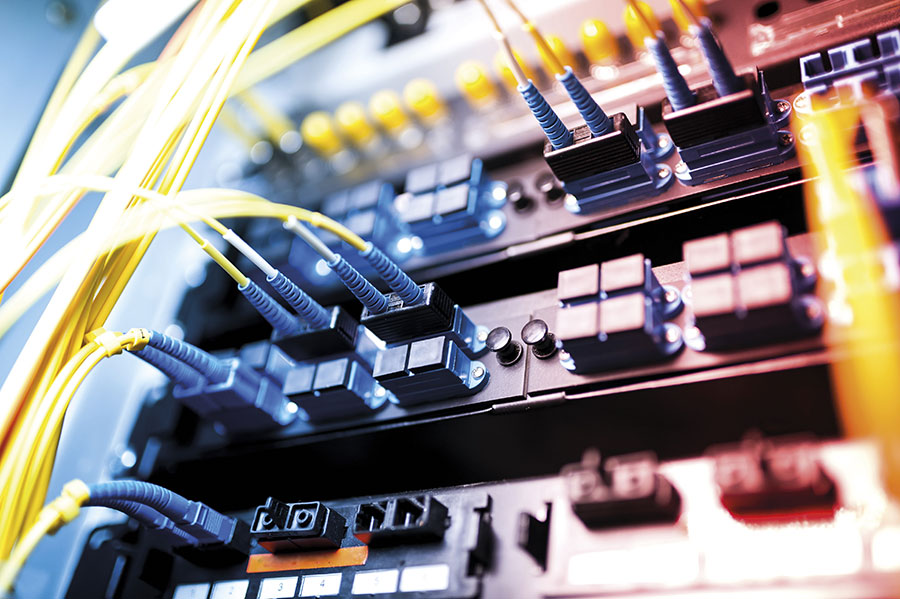

Telecom:

Profitability jumped

Continued growth in demand for opticals, with multimedia solutions also good

Sales grew organically by 1.7% to €317 million, driven by strong demand for optical cables which more than offset the decline in copper cables. Adjusted EBITDA jumped 40.1% to €75 million, with margins also improving sharply to 23.5% from 16.3% in Q1 2017. The strong results benefited from the growth in volumes, increased competitiveness and improved industrial efficiency, positive results of the Chinese associate YOFC and partial release of the provision made in 2016 against receivables in Brazil. Growth in sales for optical fibre cables benefited from broadband investment projects in Europe, and particularly France with the Très Haut Débit project. In Brazil, investments by the major telecom operators reported a slight recovery. The copper cables business was affected as expected by the decline in volumes in Australia.

Growth by Multimedia Solutions reflected increased volumes in the European market, while the high value-added business of optical connectivity also confirmed positive results, thanks to the development of new FTTx networks in Europe, particularly in France and Britain.

THE MARKET REACTION

Q1 2018 reported positive financial results. The outlook for FY2018 also reported results above market expectations (after out-stripping non-recurring effects), with strong results in Telecom and a trend of solid organic sales in the Energy Projects and Industrial & Network Components operating segments, which were offset by negative performance of OCI and unfavorable Forex impact. Net financial debt of €648 million as of 31 March 2018 was in-line with analyst’s expectations.

Analysts confirmed their view on the stock following Q1 2018 results and the FY2018 outlook release, with a few adjusting their target price valuation of Prysmian’s shares. Kepler-Cheuvreux slightly increased its target price to €32/share (from 31.5 €31.5 /share), confirming the “buy” recommendation on Prysmian shares, and including Prysmian in the “top pick” list of the broker, thanks to solidity shown by Q1 2018 results and FY2018 outlook in-line with expectations.

Both Bank of America-Merril Lynch and Morgan Stanley confirmed their positive view on Prysmian, keeping the target price at €34/share and €33/share respectively. Equita confirmed its “neutral” rating, taking Q1 2018 results and FY2018 outlook into consideration. The potential of the General Cable integration is already factored into current market prices according to the Italian broker house.

Submarine and Telecom to consolidate leadership

The Group also expects higher demand for building cables and a moderate recovery for High Voltage Underground. Financial year target rose to between €730 million and €770 million, from €736 million reported in 2017.

The first few months of 2018 have largely confirmed the growth rates achieved in 2017 by the United States and China, despite the trade tariffs on specific imported goods. The tax reform has fanned US growth, while in China, growth was driven by domestic consumption. In Europe, growth remains solid, with the main indicators high. In Brazil, gradual recovery has been confirmed.

Prysmian expects to see higher demand in the cyclical businesses of building wires and industrial applications, reflecting stronger European demand partially tempered by weakness in the Middle East. Medium voltage cables for utilities can expect largely stable demand, with a mixed performance between different areas. Energy Projects is headed towards market expansion, and the Group anticipates consolidating its leadership in submarine cables and systems in view of an expected growth in tendering activity in the second half of the year.

The Group expects HV underground to make a moderate recovery, with a steady improvement in in China thanks to the new manufacturing footprint. In Oil & Gas, stable demand is seen for new onshore projects, primarily in North America and the Middle East, thanks to the gradual rise in oil prices, while the SURF business is forecast to remain weak. Telecom should see solid organic growth, underpinned by strong demand for optical cables in North America and Europe, while copper cables are seeing slower performance due to declining demand in Australia.

In view of these considerations, the Group is forecasting a consolidated adjusted EBITDA that now includes General Cable Corporation and controlled companies in the range of €860 million and €920 million for 2018. The forecast considers, in line with the first-quarter results, a growth in volumes and margins in the Telecom operating segment, and an improvement in sales volumes by E&I and Industrial & Network Components.