Solid order intake, improved ADJ.EBITDA in Q1 2017

Quarterly overview

SOLID ORDER INTAKE, IMPROVED ADJ.EBITDA IN Q1 2017

The results for the first quarter of 2017, approved by Prysmian’s Board of Directors, showed a profitability improvement along with a sound order book.

CEO Valerio Battista stated that the first quarter of 2017 underlines “the competitiveness of the Group’s offering in high-tech, high value-added markets”. This was reflected in the award of projects like the IFA2 subsea interconnector between France and Britain and the system commissioned by RTE to connect three wind farms in France to the mainland grid, as well as the partnership agreement recently signed with Verizon to realise the “One Fiber” project in the USA. In terms of results, the Telecom business has delivered another excellent performance, in a market scenario that is not showing any signs of slowing. Organic sales growth was slightly weaker, essentially due to the timing of project execution. However, this is seen as a temporary trend that is expected to be re-absorbed in the coming quarters.

Profitability was slightly up, driven by Telecom growth, while largely stable in the Energy Projects segment, whose drop in sales was offset by growth in margins thanks to a more profitable mix. The expansion, rationalisation and technological enhancement of the Group’s industrial and manufacturing footprint has continued as has the focus on product innovation. The outlook for 2017 as a whole is positive, albeit with some caution due to uncertainties in various markets and geographical areas, and allowed to set higher profitability targets with Adjusted EBITDA in the range of €710-€750 million.

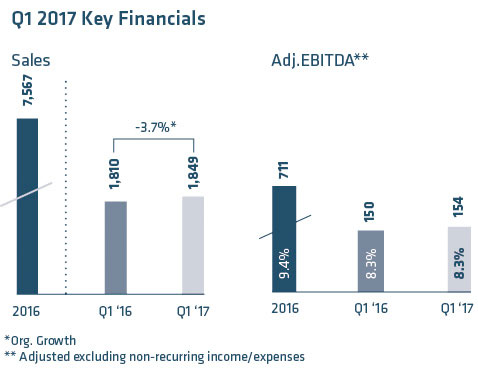

Sales

amounted to €1,849 million, decreasing organically by 3.7%, largely due to the phasing of project execution. Telecom continued to perform strongly, with an organic sales increase of +12.3%.

Adjusted EBITDA

came in at €154 million, up from €150 million one year earlier, as the decline in sales did not affect margins, that stayed stable at 8.3% on sales. To be noticed the resilience of Energy Projects, with margins improved, while Energy Products recorded a moderate decline in profitability and Oil & Gas suffered from SURF weakness in Brazil.

Net Financial Debt

stood at a sound €998 million as of 31 March 2017, down from €1,038 million one year earlier. The principal factors were:

€617 million in net cash flow provided by operating activities before changes in net working capital;

-€122 million in cash flow used by the increase in net working capital, mainly due to project phasing and the increased copper price;

-€245 million in net operating capital expenditure of which €44 million to acquire the assets of Shen Huan.

Guidance

for full year 2017 is for an Adjusted EBITDA in the range of €710-€750 million, up from €670-€720 in 2016.

Energy Projects

protected profitability

In the first four months €700 million in new transmission projects were awarded, better margins in submarine cables and systems but also in HV underground.

Prysmian Group Energy Projects Operating Segment saw sales affected by the phasing of project execution and the different mix of submarine projects, coming in at €275 million, down organically by 15.2%. Profitability though improved slightly, with Adjusted EBITDA climbing to €40 million from €39 million accompanied by a significant improvement in margins to 14.4% from 11.2%.

The decline in sales for Submarine Cables and Systems did not impact profitability, as margins improved considerably thanks to the favorable mix of projects, the growing importance of maintenance and repair activities and the full deployment of the strengthened installation capacity with Ulisse, the Group’s third cable-laying vessel along with special equipment for cable burial, that allowed to bring back in-house high-margin activities previously outsourced. Order intake came in close to €700 million since the start of the year, allowing the Group to consolidate its leading position in a still growing and high-potential market. Among the most important projects secured, the IFA2 submarine electrical interconnector between France and Britain worth €350 million, and the project to connect three offshore wind farms in France to the mainland grid, worth €300 million. The total value of the order book stands at around a robust €2.2 billion, ensuring sales visibility for a period of about two years.

Demand for High Voltage Underground Cables reported a slight weakening in the French, Dutch and North American markets, that along with the change in the scope of consolidation in China was reflected in an organic decline in sales. However, the favorable mix and growth in services generated an improvement in margins. The order book stood at around €400 million.

Slow start, for

Energy Products

Industrials and Nwc showed growth in sales and margins for automotive business, stable performance for accessories and some weakness in OEM and renewables.

Overall sales of Energy Products Operating Segment amounted to €1,180 million, with an organic decrease of -2.7%, primarily attributable to contracting volumes in Central and Eastern Europe, partially offset by positive performance in the Nordic region and growth in some Asian markets. Adjusted EBITDA amounted to €61 million with a slight fall in margins.

Energy & Infrastructure sales amounted to €806 million, while Adjusted EBITDA was €35 million compared with €38 million in the first quarter of 2016. Trade & Installers were penalised in the first part of the year by weak performance in Central and Eastern Europe, Turkey and Argentina, partially offset by positive trends in the Nordic region and Oceania. The rise in copper prices temporarily affected profitability. The European Construction Products Regulation, coming into force from 1 July 2017 and imposing higher standards of quality and safety, represents an important opportunity for the Group, which already boasts a competitive range of products at the top end of the market.

Power Distribution reported stable volumes and higher profits despite the challenging basis of comparison with the same period of 2016. The Nordics and APAC performed well, while Central/Eastern Europe and Argentina were weak.

Industrial & Network Components sales amounted to €340 million, while Adjusted EBITDA was €27 million compared with €29 million in the first quarter of 2016. Order book started to recover after two consecutive quarters of decline. A positive performance was recorded for Medium and Low Voltage accessories, offsetting the weakness in High and Extra High Voltage. France, Italy and the Netherlands were affected by unfavourable market conditions, while the United States, Britain and Brazil recorded solid growth. Specialties&OEM and Renewables reported weak organic sales. Growth in APAC was not sufficient to offset the slowdown in Europe and North America. Railway sales were good, while Renewables, Crane and Nuclear soft. The Elevators business recorded a slight slowdown due to the delay of some projects in China. Doubledigit organic growth and improved margins marked the results of the Automotive business, thanks to solid performance in North America, South America and APAC, while reorganisation of the manufacturing footprint in Europe improved the business’s competitiveness in the region.

Signs of recovery for core

Oil & Gas

Lower volumes and lower prices for umbilicals in line with expectation, with moderate decline in downhole technology. Results recovering in North America.

The performance of the Oil & Gas Operating Segment was still influenced by the industry crisis, which is affecting investment decisions by major players. Sales came in at €66 million, down -21.2%. Adjusted EBITDA was a break-even, from €3 million in the same period of 2016.

In the business Subsea Umbilicals Risers and Flowlines business the contraction in Umbilical volumes and prices was as expected and reflected the low level of orders in Brazil. Price pressure in tenders during the first few months of 2017 continued.

The Downhole Technology business posted a positive performance in North America thanks to a resumption of activity in the shale oil & gas industry which partially offset the negative effects of delays for some major deepwater projects.

There were signs of recovery in the Core Oil & Gas business with an improvement in underlying sales thanks to onshore projects in the Middle East, Russia and ASEAN and to the resumption of drilling activities in North America. The Group continued to keep a tight focus on Design-to-Cost and actions in the supply chain to limit the impact of lower prices.

Telecom:

solid performance driven by opticals

Profitability improved furthermore with positive market trends in Europe and North America.

Our Telecom Operating Segment sales climbed organically by 12.3% to €328 million in the first quarter driven by strong demand for optical cables. Adjusted EBITDA jumped by 26.8% to €53 million, with margins further improving to 16.3% from 15.4% in the same quarter of 2016.

The Telecom Solutions business won important contracts with leading operators in Europe for the construction of backhaul links and FTTH connections. The network development plan in rural areas is progressing in the Netherlands, and the broadband project Trés Haut Débit in France continues to be rolled out, while the development of new ultra-wideband networks in North America is generating a steady increase in domestic demand.

As part of a massive multi-year investment program by Verizon, Prysmian has signed a three-year agreement to supply 17 million fibre km of cables worth about $300 million. In Brazil, there has been a slight recovery in investments by the major telecom operators.

The results of the Multimedia Solutions business mainly reflected increased volumes on the European market for copper data cables at a local level and to a lesser extent in South America. The Group’s investments in expanding production capacity in Europe, with the acquisition of the Corning plant in Germany, also made a substantial contribution by allowing it to meet growing market demand. The high value-added business of optical connectivity also confirmed positive results, thanks to the development of new FTTx networks in Europe, particularly in France and Britain.

MOST BROKERS ON A POSITIVE NOTE

Brokers’ comments to Q1 2017 results were generally positive, as operating results came out in line with expectations, with a stronger than expected performance of Telecom business offset by weaker Projects. 2017 outlook on the other hand was considered to be conservative compared to initial market projections.

Most brokers confirmed their recommendation and target price, while a few brokers (namely KeplerCheuvreux, Fidentiis and Banca IMI) reduced their rating from BUY to NEUTRAL / HOLD. JP Morgan increased its target valuation from 26.5 €/share to 27.0 €/share while confirming the OVERWEIGHT recommendation; Bank of America – Merrill Lynch confirmed the BUY rating and target price of 28.5 €/share, reaffirming the positive view on solid mid-term growth opportunities. Barclays confirmed its NEUTRAL view after reducing the target price to 28.0 €/share from 29 €/share, focusing its attention on encouraging M&A indications provided by the management during the analysts call.

Upbeat targets set on positive FY outlook

The Group is forecasting Adjusted EBITDA for FY 2017 in the range of €710-750 million, up from the €711 million reported in 2016.

The first few months of 2017 witnessed moderate but steady growth in the Eurozone, with confidence indicators improving. Growth in the US was slower than expected in first quarter amid uncertainty over the announced reforms. Russia and Brazil continued to show signs of gradual improvement, while China exceeded expectations thanks to government-driven infrastructure investments.

In such a context Prysmian Group expects that in 2017 cable demand in the cyclical businesses of building wires and medium voltage cables for utilities will be largely stable. As Energy Projects continues to enjoy a growing market, we also expect to consolidate our market leadership and improve profitability in the Submarines, while a slight decline in the High Voltage underground business is foreseeable partly due to the change in the scope of consolidation following reorganisation of the manufacturing footprint in China.

Oil price dynamics are setting in motion a recovery in Core Oil & Gas cables, thanks to onshore drilling activities in North America and onshore projects in the Middle East, ASEAN and Russia. Conversely, the SURF business, featuring longer project cycles, is expected to continue to perform poorly. In the Telecom segment, the underlying growth in the Group’s turnover is expected to remain strong in 2017, thanks to rising demand in North America and Europe, accompanied by a gradual stabilisation of volumes in Australia. Assuming exchange rates remaining stable, the translation into the reporting currency is not expected to have a material impact on 2017 operating income.

The Group is forecasting Adjusted EBITDA for FY 2017 in the range of €710-750 million, up from the €711 million reported in 2016. This forecast is not only based on the Company’s current business perimeter but also takes into account the current order book.