Stable organic growth in 2017

markedly improving in Q4

Quarterly overview

Stable organic growth in 2017 markedly improving in Q4

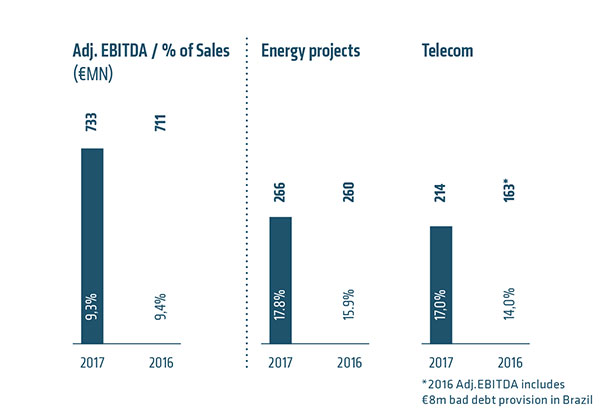

Profitability also improved with Adjusted EBITDA up 3.1% to €733 million, and higher margins for Energy Projects and Telecom.

The Board of Directors of Prysmian Group has approved the results for financial year 2017, which has closed in line with expectations, reporting stable organic sales with an improvement in the fourth quarter. CEO Valerio Battista, commenting on the growth in profitability, with Adjusted EBITDA rising to €733 million, underlined the “significant improvement in margins” for the higher value-added businesses of Energy Projects and Telecom.

The Telecom business continued to report strong growth in demand for optical cables, supported by the development of broadband networks and investments in preparation for 5G.

The combined positive performances, stated the CEO, “have allowed us to achieve our guidance targets once again in 2017 and to propose our shareholders a dividend of €0.43 per share”. Looking to the future, Mr Battista reiterated the satisfaction for the General Cable shareholders’ approval of the acquisition proposal that has confirmed the expectation of closing the transaction by the third quarter of 2018.

The €500 million capital increase being submitted for shareholders’ approval is intended to maintain sufficient financial flexibility for the Company.

Sales

amounted to €7,901 million, posting an organic variation of -0.1%. Fourth-quarter performance was of particular note, with organic growth of +2.9% reflecting strong sales of optical cables and gradual recovery for the E&I and Industrial & Network Components businesses.

Adjusted EBITDA

climbed to €733 million, up 3.1% from €711 million in the previous year despite adverse exchange rate effects of €11 million. The largest contribution came from excellent performances by Energy Projects and Telecom. The margin on Energy Projects sales improved to 17.8% from 15.9% in 2016, while the Telecom segment’s margin increased to 17.0% from 14.0%

Net profit

amounted to €223 million (€227 million attributable to owners of the parent) compared with €262 million in 2016 (€246 million attributable to owners of the parent).

Net Financial Debt

amounted to €436 million at the end of December 2017, having improved from €537 million at the close of 2016. The principal factors influencing the balance were €613 million in cash flow provided by operating activities, €104 million in tax payments, €254 million in net operating capital expenditure, €101 million in dividend pay-outs and €100 million to buy back the Company’s shares.

Energy Projects

Better Submarine profitability

The business posted sound order intake and better profitability. Change in scope in China depresses High Voltage underground. Order book at €2,450 million.

Energy Projects sales stood at €1,490 million in 2017, declining 4.8% organically on 2016, while profitability was sharply up, with Adjusted EBITDA climbing 2.3% to €266 million with the margin rising to 17.8% from 15.9% underpinned by the higher level of vertical integration in installation and by sound execution.

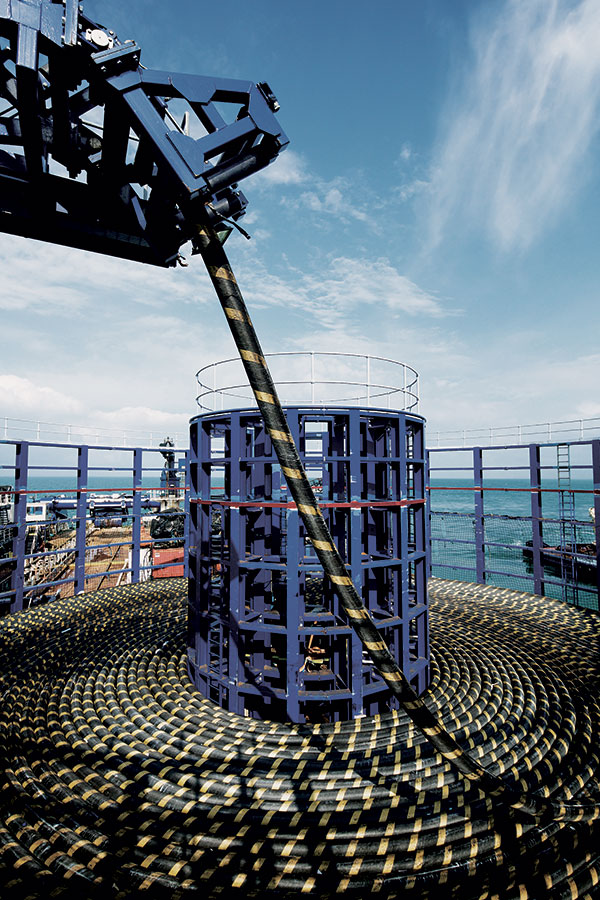

Submarine Cables and Systems secured a number of important contracts not only to build interconnectors, such as the IFA2 submarine link between Britain and France and the project for a new interconnection in the Philippines, but also for offshore wind farm connections, like the projects to link three offshore wind farms to the French electricity grid.

The robust order intake of around one billion euros confirms the Group’s undisputed technological and market leadership in the submarine business. Higher profitability has been supported by the growing vertical integration of installation activities and by sound execution. The segment of High Voltage Underground power transmission saw a sharp uptrend in sales in South East Asia and a solid execution of turnkey projects in EMEA and the Middle East. EBITDA was affected by the change in scope in China and by weak performance in Britain, the Nordics and Russia, while positive results were recorded in Asia Pacific and France. The new Prysmian Technology Jiangsu is now up and running in China, making it possible to offer a wide range of cable voltages and technologies.

The Energy Projects order book stood at €2,450 million as of 31 December 2017.

Energy Products

Moderate sales growth

Trade & Installers continued to benefi t from CPR, marginal retreat for Power Distribution Industrial & NWC. Sales grew organically by 0.9% to €4,880 million attributable to positive performance in North America and Asia, while volumes contracted in some countries in Central and Southern Europe and in North America. Adjusted EBITDA amounted to €244 million.

Energy & Infrastructure sales came in broadly stable at €3,271 million with Adjusted EBITDA of €130 million and a margin on sales of 4.0% versus 5.1% the year before.

Trade & Installers showed a moderate improvement, supported by the fi nal implementation of the new European Construction Products Regulation (CPR). Profi tability was negatively impacted by market weakness in the Middle East.

Power Distribution reported a decline in organic sales, with a slight recovery posted in the fourth quarter. Positive performances in North America and Asia Pacifi c made up for subdued markets in Central and Eastern Europe, Britain and the Middle East.

Sales of Industrial & Network Components achieved a 3.5% growth to €1,460 million thanks to the Group’s ability to off er a wide range of products for diff erent fi elds of application and highly customisable solutions. Adjusted EBITDA was slightly lower at €115 million, with margin on sales at 7.9% versus 9.5% in 2016.

Specialties & OEMs enjoyed positive organic sales growth, accelerating in the fourth quarter, with good performance in Railway and Infrastructure, partly off set by a slowdown in Renewables, Defence and Crane. Elevators recorded a minor increase in organic sales, while sustained demand and a growth in market share in North America, APAC and Brazil allowed the Automotive business to achieve double-digit organic sales growth. Network Components recorded a slight decline in organic sales.

Oil & Gas

Sales in the Core pick up

But decline in SURF sales continued to aff ect the segment. Focus on optimising manufacturing footprint and supply chain e ffi ciency.

The segment continued to be penalised by the adverse performance of the SURF business, while sales in the Core Oil & Gas Cables picked up. Sales came in at €273 million, with an organic decrease of 10.8%, but with signs of easing in the fourth quarter, down 4.3% on one year earlier. Adjusted EBITDA improved to €9 million from €8 million with margin on sales also up to 3.4% from 2.7%.

Sales of the Core business recovered thanks to resumed demand for onshore projects in the Middle East, Russia and United States, while the off shore market remained weak. Profi tability benefi ted from resurgence in volumes, optimisation of the manufacturing footprint and reduction in manufacturing costs.

In the SURF business, umbilicals were aff ected by the deterioration in volumes and margins in the wake of low order intake in 2016 and price pressure in the Brazilian market, which remained extremely challenging.

Telecom:

Margins hit all time high

Optical cables posted continued double-digit organic growth. Marked improvement in profi tability.

Sales climbed organically by 5.3% to €1,258 million while Adjusted EBITDA jumped 31.1% to €214 million with margins also improved to 17.0% of sales from 14.0% - the highest ever level - benefi ting from the investments to improve fi bre manufacturing e ffi ciency, from the growth in volumes and the contribution of YOFC.

The optical cables business posted double-digit organic growth underpinned by favourable market conditions, notably in North America and Europe, specifi cally France and Italy, where strong demand was supported by investment spending on broadband and preparations for the introduction of 5G technology.

In North America a three-year agreement was secured to supply optical fi bre cables starting from January 2018 to major operator Verizon. The Group will increase the production capacity of its North American plants to support the growth trend.

The weakness of the copper cable business, in line with expectations, was mainly due to conclusion of the National Broadband Network project in Australia. The high value-added business of optical connectivity accessories performed well thanks to the development of new FTTx networks in Europe, specifi cally in France and Britain. The recent tender by China Mobile for the procurement of optical cables confi rms the sustainability of market growth also in 2018.

THE MARKET REACTION

FY 2017 results were substantially in line with market expectations, thanks to strong margin growth by Telecom and Energy Projects, offsetting the slowdown in the Middle-East (OCI) and negative forex impact. Organic growth in Q4 was better than expected, driven by the continued solid trend in Telecom and the gradual recovery of the E&I and Industrial segments. Net Financial Debt as of 31 December 2017 was the main positive surprise to the market, being substantially lower than expectations thanks to strong cash generation during Q4.

Following the results, a few analysts adjusted their Target Price for Prysmian, without changing their investment recommendation. In particular, both Bank of America-Merril Lynch and Morgan Stanley confi rmed their positive view on the stock, leaving their Target Price at 34 Euro/share and 33 Euro/share respectively.

Kepler-Cheuvreux reiterated its “BUY” recommendation following the results, focusing on the potential upside deriving from the possible integration with General Cable. Among the more prudent views were Equita and Barclays, which have stuck to their “NEUTRAL” rating, as according to the brokers, the potential upside deriving from the possible acquisition of General Cable has already been factored into the current market price.

Submarine and Telecom to consolidate leadership

The Group expects higher demand for building wires with stronger demand in Europe, while HV underground is seen to make a moderate recovery.

The global macroeconomic cycle gained steam in 2017, with all the main areas improving, driven by the Eurozone and a resumption of growth in certain emerging countries, such as Brazil and Russia. In the U.S., growth has become steadily stronger thanks to positive eff ects of the tax bill. China’s growth was solid throughout the year, outperforming expectations. In such a context, the Group expects in 2018 that demand in the cyclical businesses of building wires and industrial applications will be higher, refl ecting stronger European demand as partially tempered by weakness in the Middle East, while demand for medium voltage cables for utilities should be stable, reflecting a mixed performance between the diff erent areas.

With market expansion forecast, Prysmian Group’s Energy Projects segment anticipates consolidating its leadership in Submarine cables and systems while boosting the business’s profi tability through the strategy of insourcing installation activities. The Group also expects High Voltage underground cables and systems to make a moderate recovery, with steady improvement anticipated in China thanks to the new manufacturing footprint. In the Oil & Gas segment, cable demand for onshore projects is seen stable, while the SURF business is forecast to remain weak due to price pressures in the Brazilian market.

The Telecom segment should see solid sales growth, sustained by strong demand for optical cables in North America and Europe, while copper cables can expect to lag further due to declining demand in Australia. Prysmian Group will continue in 2018 to rationalise its activities with the objective of achieving projected cost effi ciencies and greater competitiveness in all areas of its business.

in 2018 the business of building wires will be higher