A growth milestone

Focus On

A growth milestone

Prysmian Group set a further path towards growth and strengthened its global leadership with a merger deal sealed with General Cable.

Through the combination of two of the premier companies in the cable industry, we will be enhancing our position in the sector, by increasing our presence in North America and expanding our footprint in Europe and South America”.

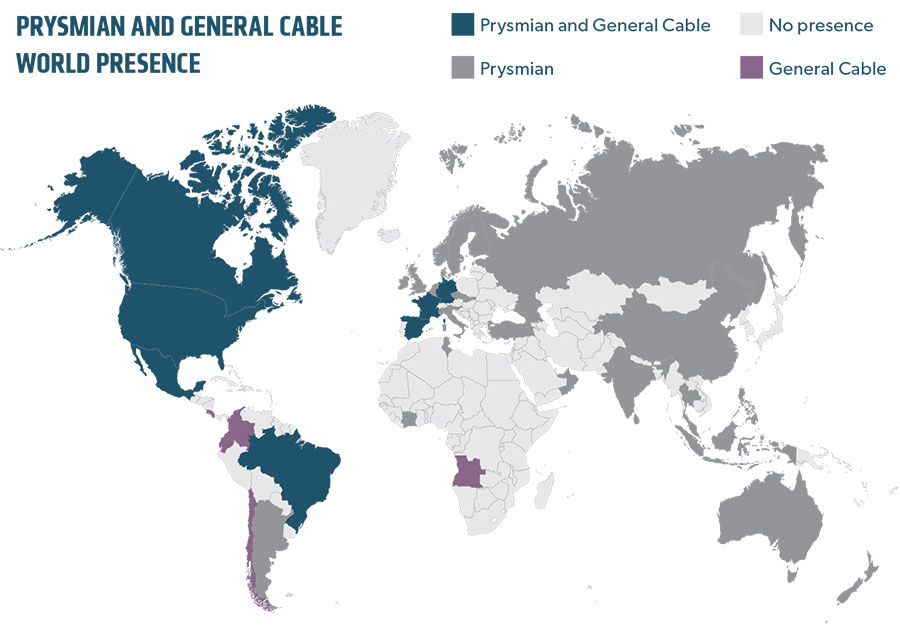

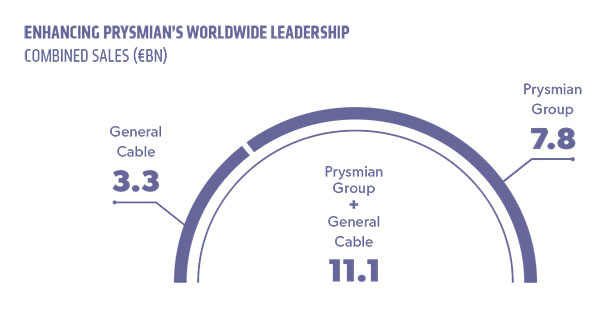

On 4 December 2017, Prysmian Group and General Cable Corporation announced they have entered into a merger agreement that represents a unique opportunity in the Group’s plan to enhance its worldwide leadership. The deal will see Prysmian Group acquire the U.S. company for USD 30.00 per share in cash for approximately USD 3 billion. This, combined with the company’s net debt and other liabilities, is expected to generate combined sales of over 11 billion euros, and adjusted EBITDA of about 930 million euros.

The combined group, which will be present in more than 50 countries with approximately 31,000 employees, will also result in high geographical presence with a major exposure increase in North America, along with expansion in Europe and Latin America.

The combined group is expected to generate run-rate pre-tax cost synergies of approximately 150 million euros within five years, following closing mainly from procurement, overhead costs savings and manufacturing footprint optimisation. Further synergies are expected.

The combined group is expected to generate run-rate pre-tax cost synergies of approximately 150 million euros within five years, following closing mainly from procurement, overhead costs savings and manufacturing footprint optimisation. Further synergies are expected.

One-off integration costs are estimated at approximately 220 million euros.

“The acquisition of General Cable represents a landmark moment for Prysmian Group and a strategic and unique opportunity to create value for our shareholders and customers” - said Prysmian Group CEO Valerio Battista. He continued: “Through the combination of two of the premier companies in the cable industry, we will be enhancing our position in the sector by increasing our presence in North America and expanding our footprint in Europe and South America.”

The combination is seen by Michael T. McDonnell, General Cable President and Chief Executive Officer, as “an ideal strategic fit that ensures we meet future opportunities and challenges in the dynamic and evolving wire and cable industry”. According to McDonnell, the combined entity “will be able to deliver a robust portfolio of products and services and new product innovation across the full breadth of the wire and cable industry globally”. He stresses that Prysmian Group and General Cable “have a shared vision and highly compatible cultures founded on similar values”.

On 16 February 2018, a Special Meeting of the General Cable Corporation shareholders, attended by approximately 75.34% of the share capital entitled to vote, returned a vote of some 99% in favour of the acquisition. The completion of the acquisition is expected to take place by the third quarter of 2018, subject to regulatory approvals and other customary closing conditions.

One-off integration costs are extimated at approximately €220 million

powerful industry aggregator

The combined entity will be able to deliver a robust portfolio of products and services. Michael T. McDonnell, General Cable President and CEO

The Prysmian history is one of growth, both organic and through the acquisition of top cable manufacturers across the world. In recent times, this journey accelerated through a strong campaign that included the acquisition of brands such as Siemens Energy Cables, Metal Manufacturers, NKF Holland, Nokia Finland and BICC General.

In 2010, as Prysmian became a full public company listed in the Milan Stock Exchange, it decided to combine with the Dutch player Draka, creating a global leader in the cable industry.

The assets and the know-how capitalised by the two allowed the new Prysmian Group to embark in a drive of renewed growth in the world’s high-value cables and systems market. The new journey was rewarded with increasing profi tability and the appreciation of investors and fi nancial markets.

In the following years, further important acquisitions were made: in September 2015 Prysmian acquired US company Gulf Coast Downhole Technologies, further strengthening the existing presence in the Oil & Gas sector.

In December 2015, it gained the majority stake in Oman Cables Industry, the top cable manufacturer in the Gulf area – and one year later, acquired the assets of the Shen Huan Cable shift ing to an independent high voltage off er in China.