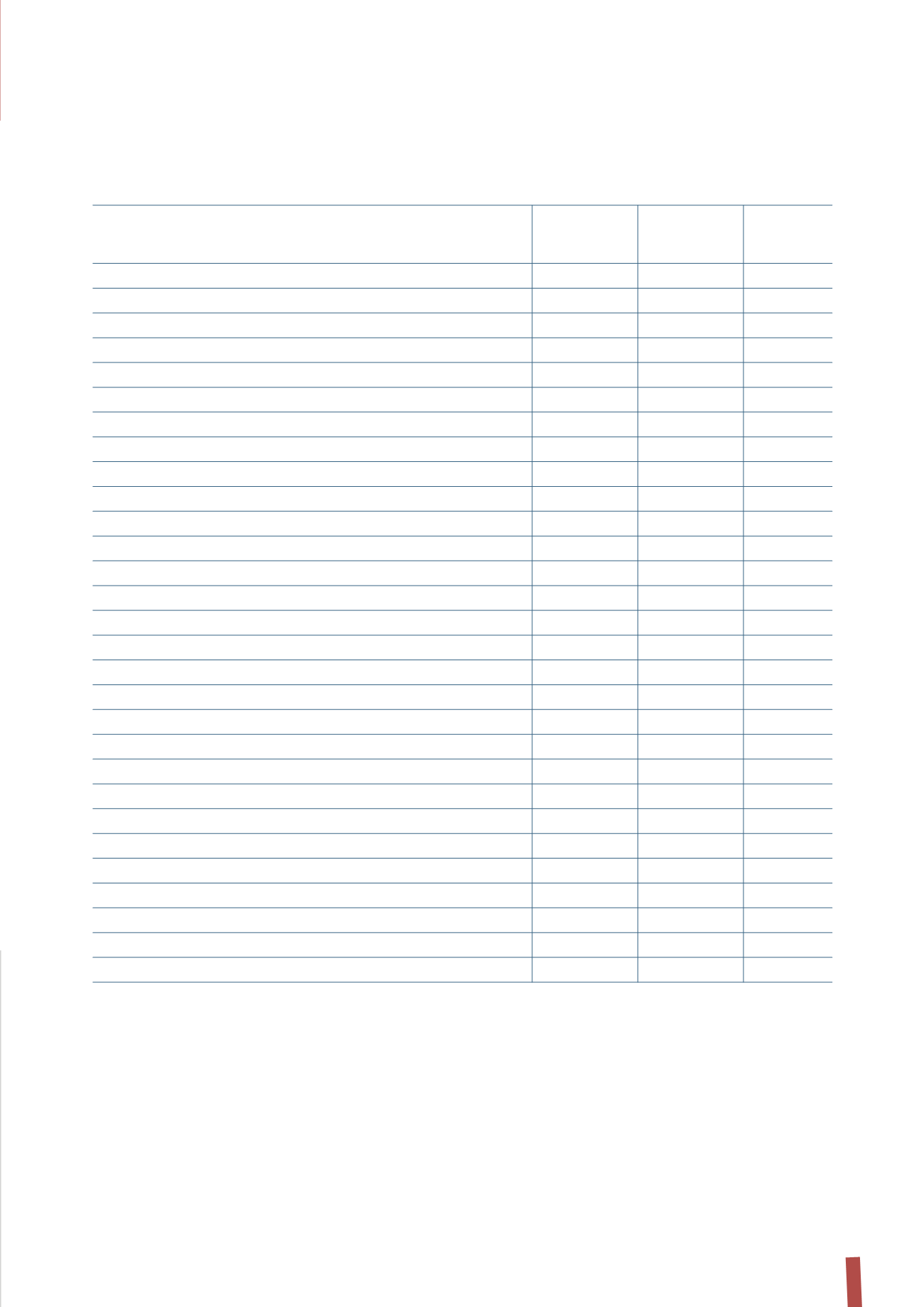

295

STATEMENT OF CASH FLOWS

(in thousands of Euro)

2012

Of which

2011

Of which

related parties

related parties

(Note 23)

(Note 23)

Profit before taxes

90,922

57,065

Depreciation and impairment of property, plant and equipment

869

694

Amortisation and impairment of intangible assets

7,816

6,370

Share-based compensation

5,557

2,503

Dividends

(150,000)

(150,000)

(161,332)

(161,332)

Net finance costs (income)

35,408

(15,641)

39,176

(12,597)

Changes in trade receivables/payables

(60,708)

(50,258)

(6,852)

(3,172)

Changes in other receivables/payables

(4,624)

(49,351)

2,627

4,807

Taxes collected/(paid) ²

30,170

30,657

14,700

22,147

Utilisation of provisions (including employee benefit obligations)

(1,531)

(2,044)

Increases in provisions (including employee benefit obligations)

11,091

34,069

Transfer of employee benefit obligations

522

35

A. Net cash flow provided by/(used in) operating activities

(34,508)

(12,989)

Acquisitions ¹

(8,886)

(8,886)

(501,129)

(501,129)

Investments in property, plant and equipment

(2,237)

(859)

Disposals of property, plant and equipment

623

-

Investments in intangible assets

(9,336)

(9,170)

Investments to recapitalise subsidiaries

(254,000)

(254,000)

-

Dividends received

150,000

150,000

161,332

161,332

B. Net cash flow provided by/(used in) investing activities

(123,836)

(349,826)

Finance costs paid ³

(46,624)

(124)

(53,184)

(124)

Finance income received

4

12,260

12,076

11,013

10,919

Changes in financial receivables/payables

236,058

(30,970)

438,116

51.645

Capital increases

5

536

2,509

Dividend distribution

(44,395)

(35,082)

C. Net cash flow provided by/(used in) financing activities

157,835

363,372

D. Total cash flow provided/(used) in the year (A+B+C)

(509)

557

E. Net cash and cash equivalents at the beginning of the year

1,190

633

F. Net cash and cash equivalents at the end of the year (D+E)

681

1,190

¹ The figure of Euro 8,886 thousand represents the cash outlay to purchase

the remaining ordinary shares in Draka Holding N.V., after

completing the squeeze-out procedure on 27 February 2012.

² Refer to receipts relating to group tax filing receivables from Italian Group

companies for the transfer of IRES (Italian corporate

income tax) for 2012, net of IRES and IRAP (Italian regional business tax)

paid by the Company.

³ Finance costs paid comprise Euro 35,597 thousand in interest expense paid

in 2012 (Euro 31,839 thousand in 2011), of which Euro

21,000 thousand in interest on the bond, Euro 675 thousand on the Term

Loan (for the portion received by Prysmian S.p.A. under

the Credit Agreement), Euro 5,226 thousand on the Term Loan 2010 and

Euro 8,696 thousand on the Term Loan 2011, and Euro

10,810 thousand in bank fees and other costs relating to the current credit

agreements.

4

Finance income received includes Euro 9 thousand in interest collected in

2012 (Euro 22 thousand in 2011), Euro 4,370 thousand in

amounts collected from Group companies for recharges of part of the bank

fees incurred by Prysmian S.p.A. after entering into the

Credit Agreement 2010, and Euro 7,696 thousand in amounts collected

from Group companies for recharges of fees for guarantees

given by the Company on their behalf.

5

Refer to increases in share capital, of Euro 12 thousand, and in the share

premium reserve, of Euro 524 thousand, as a result of

stock options exercised in 2012.

Please refer to Note 28 for comments on the statement of cash flows.