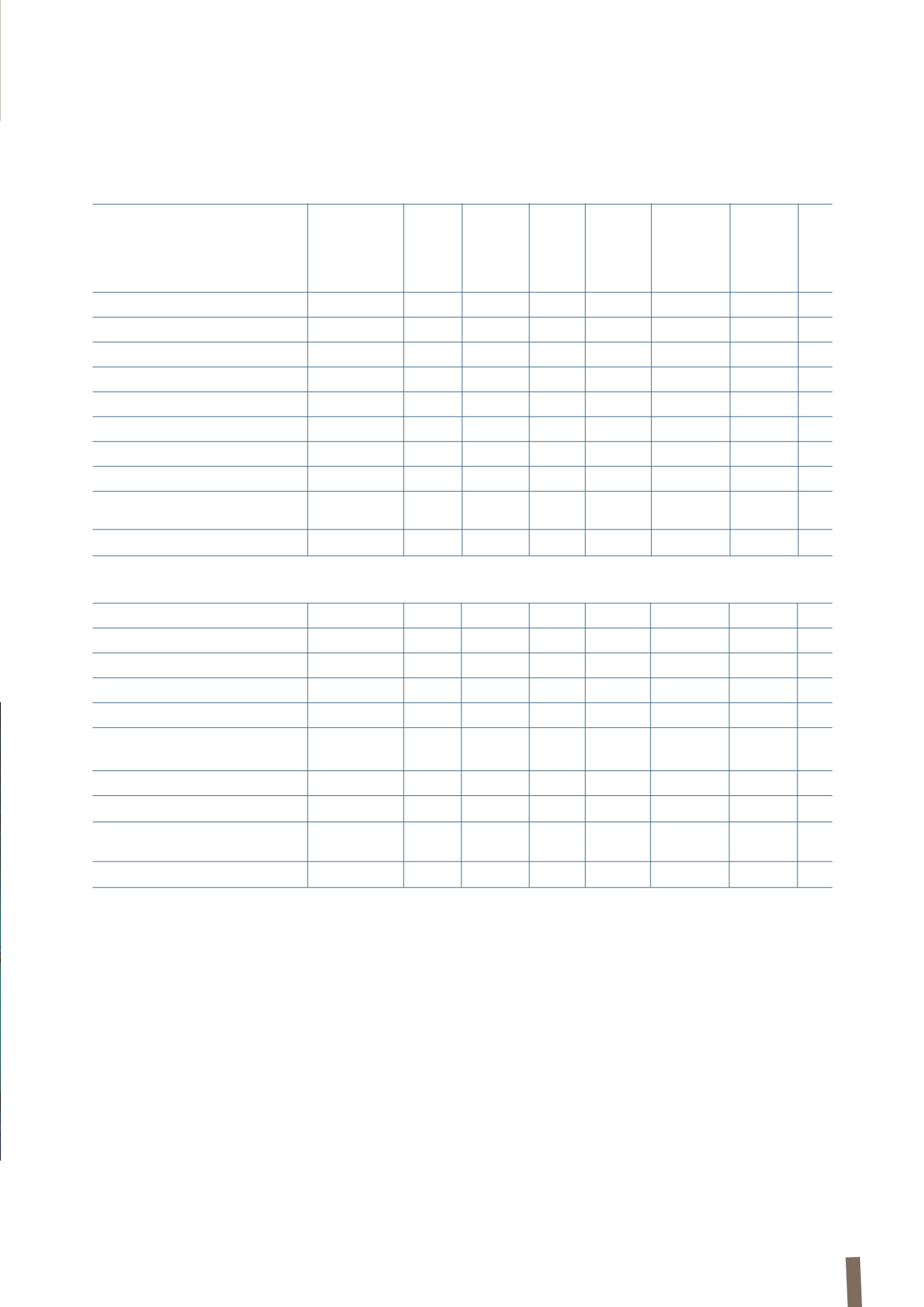

155

(in millions of Euro)

Share Fair value gains Cash flow Currency Other Net profit/

Equity

Non- Total

capital

and losses on hedges translation reserves

(loss) attributable controlling

available-forsale

reserve

for the to the Group interests

financial

year

assets

Note 11

Note 4

Note 8

Note 11

Note 11

Note 11

Note 11

Balance at 31 December 2010

18

-

(13)

(31)

634

148

756

43

799

Allocation of prior year net profit

-

-

-

-

148

(148)

-

-

-

Capital contributions

3

-

-

-

476

-

479

-

479

Capital increase costs

-

-

-

-

(1)

-

(1)

-

(1)

Dividend distribution

-

-

-

-

(35)

-

(35)

(2)

(37)

Fair value - stock options

-

-

-

-

7

-

7

-

7

Change in scope of consolidation

-

-

-

-

-

-

-

31

31

Total comprehensive income/(loss)

for the year

-

-

(4)

(5)

(19)

(136)

(164)

(10) (174)

Balance at 31 December 2011

21

-

(17)

(36)

1,210

(136)

1,042

62 1,104

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(1)

This amount refers to the squeeze-out procedure to purchase the shares of Draka Holding NV, and to the acquisitions of Draktel Optical Fibre S.A. and Neva

Cables Ltd.

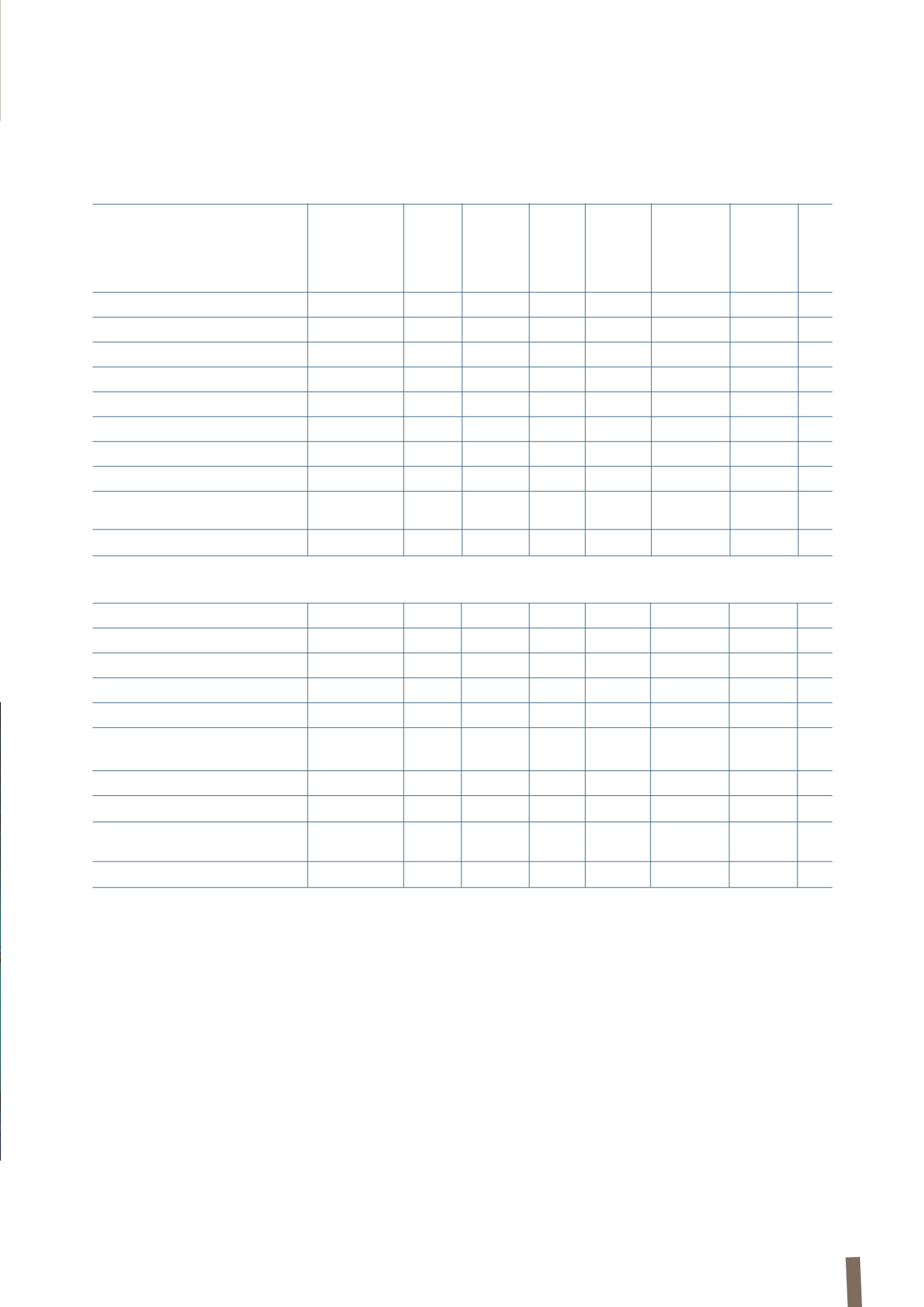

Balance at 31 December 2011

21

-

(17)

(36)

1,210

(136)

1,042

62 1,104

Allocation of prior year net result

-

-

-

-

(136)

136

-

-

-

Capital contributions

-

-

-

-

1

-

1

-

1

Fair value - stock option

-

-

-

-

17

-

17

-

17

Dividend distribution

-

-

-

-

(44)

-

(44)

(1) (45)

Non-controlling interests acquired

in subsidiaries

(1)

-

-

-

-

(3)

-

(3)

(9)

(12)

Change in scope of consolidation

-

-

-

-

-

-

-

(10)

(10)

Put option release

-

-

-

-

9

-

9

-

9

Total comprehensive income/(loss)

for the year

-

-

(6)

(26)

(46)

168

90

5 95

Balance at 31 December 2012

21

-

(23)

(62)

1,008

168

1,112

47 1,159