Financial market performance

Financial market performance

On the whole, 2016 showed a stabilisation in the global macro environment, with slowdown in the United States offset by a recovery in emerging economies and a stabilisation of growth in Europe.

The main European stock indexes had a mixed trend, with the markets of Southern Europe (FTSE MIB - 10.2%; IBEX -2.0%) weaker than those of the centre–north (CAC40 +4.0%, DAX +6.9%). In the US, the Dow Jones Industrial grew by 13.4% while the Nasdaq rose by 7.5%, both to record highs. Among the major emerging country indexes, the Brazilian market index (Bovespa) recorded a 38.9% increase, reflecting expectations for an economic rebound in 2017 after more than two years of recession. In China, the Hong Kong Hang Seng index remained largely unchanged during the year (+0.4%), while the Shanghai Shenzhen index (A Shares) lost 14.7% in the aftermath of the speculative stockmarket bubble burst of 2015.

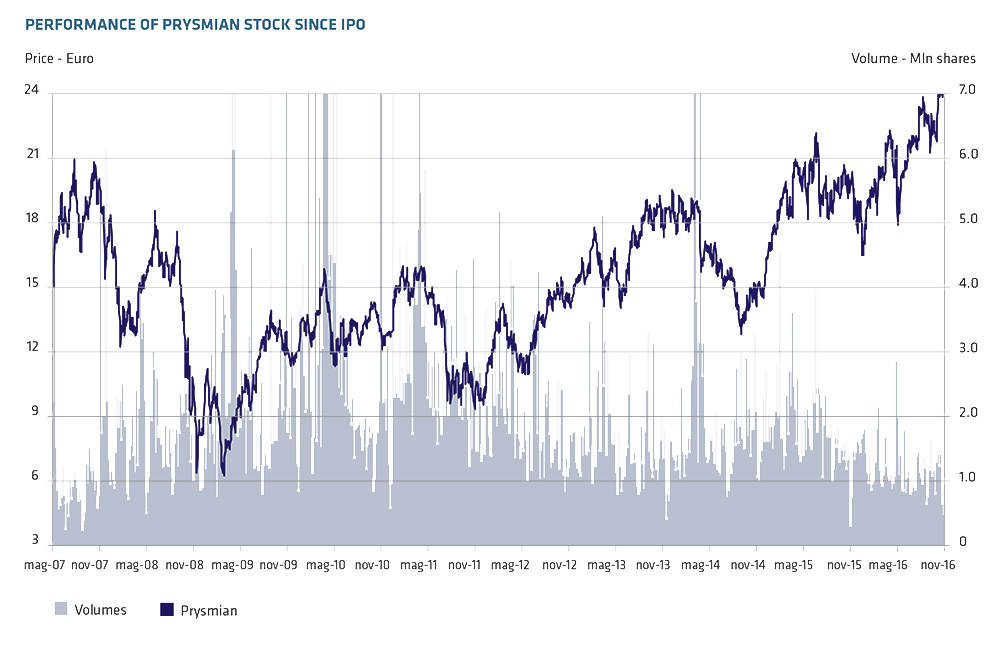

The Prysmian stock appreciated 20.4% over the course of 2016, climbing from Euro 20.26 at 30 December 2015 to Euro 24.40 at the end of 2016. On 29 December 2016, the stock price reached Euro 24.42, its highest since listing, while the average price over the twelve months was Euro 20.93, also its highest ever.

The stock's performance, including dividend pay-outs (total shareholder return), was +22.5% over the course of 2016 and +84.7% since listing. Excluding the contribution of dividends, the stock's appreciation was +20.4% in 2016 and +62.7% since listing.

The Prysmian stock's strong performance in 2016 was supported by the solidity of the Group's results (both in terms of organic growth and profitability) as well as its consistent ability to generate cash and pay dividends.

A global shareholding structure

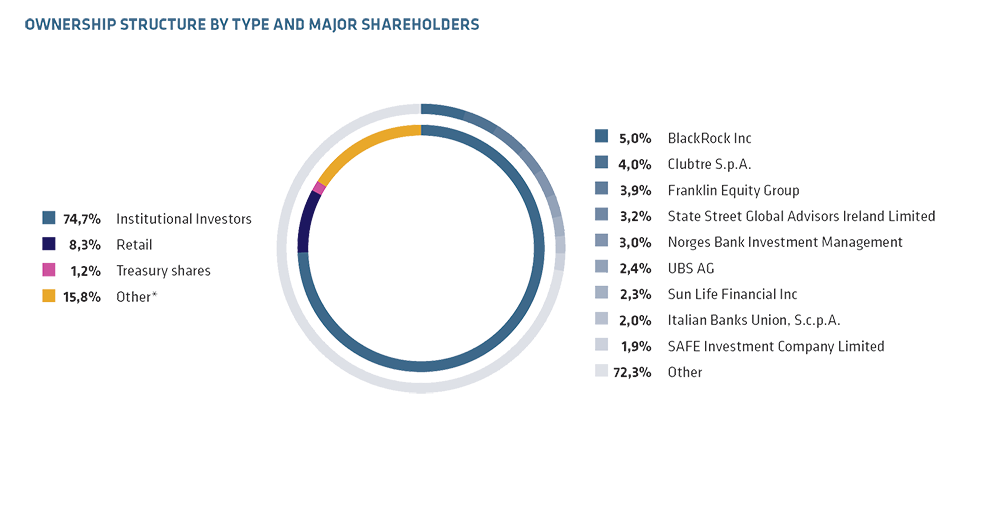

Prysmian Group can be considered a Public Company to all intents and purposes: its free float is equal to 100% of the shares, with nearly 80% of its capital held by institutional investors.

At 31 December 2016, the Company's free float was equal to 100% of the outstanding shares and major shareholdings (in excess of 3%) accounted for approximately 12% of total share capital, meaning there were no majority or controlling interests. Prysmian is now one of Italy's few globally present industrial concerns to have achieved true Public Company status in recent years.

At 31 December 2016, the share capital of Prysmian S.p.A. amounted to Euro 21,672,092.20, comprising 216,720,922 ordinary shares with a nominal value of Euro 0.1 each.