A new study from FTTH Council Europe & Plum Consulting looks at what needs to be done to increase fibre take-up. Plum Consulting team has carried out a thorough analysis of the FTTH Council Europe data and carried out a deep dive into 8 selected countries. This has resulted in a series of recommendations for measures that policymakers and industry executives will find useful when considering how to increase FTTH adoption.

Plum Consulting identified three types of factors that could explain the level of FTTH/B take-up in the different countries under study.

- Socioeconomic factors, such as income levels and distribution, poverty rates, GDP

- Digital supply factors, such as broadband prices, quality of existing copper network, broadband speeds

- Digital demand factors such as digital literacy, consumer equipment ownership, broadband usage levels

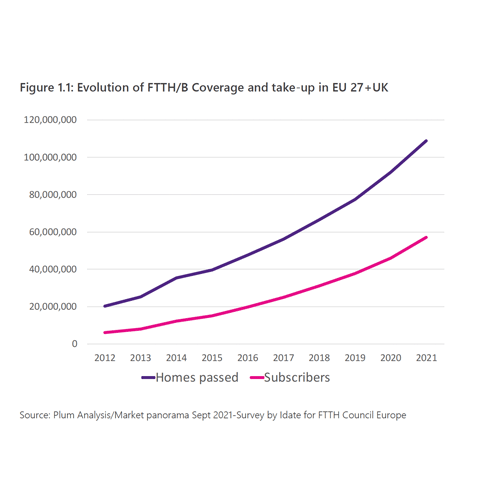

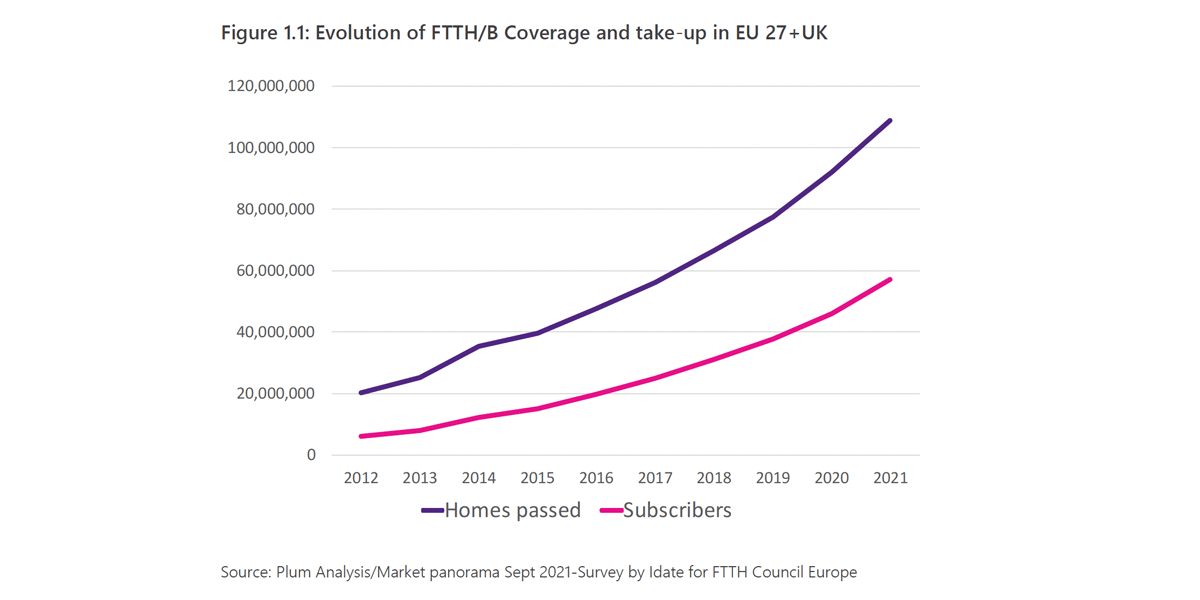

The study makes clear that FTTH/B coverage is a key driver of take-up: if a country has low overall coverage, take-up rates will generally also be low. “There is likely a virtuous cycle where deployment drives take-up, which in return encourages deployment”, explains the report. The reverse may also be true: poor take-up may slow deployment.

What’s more, a relatively strong negative correlation exists between take-up and the price of very-high-speed broadband. There is significant price variance across Europe. Pricing difference between legacy offers and FTTH/B is important for making fibre offers attractive. However, price difference with alternative solutions can also push users towards mobile solutions, for example.

The focus on deploying Docsis 3.1 / FTTC over the last decade has proven to be the main hurdle to FTTH/B adoption. Advertising regulations that have allowed market players to sell FTTC and/or cable with “fibre speeds” has made this situation worse. Differentiation is harder for FTTH/B offers and consumers are often less interested in upgrading to fibre. Awareness could be addressed by mandating clear and fair advertising rules. Governments, especially local governments, can also play an important role in increasing awareness about fibre connectivity benefits

The report offers a set of recommendations for policymakers to ensure deployment and adoption goals are aligned. Some of the key takeaways:

- Voucher schemes and associated programs designed to facilitate broadband adoption for low-income households should promote the best network solution available in each location.

- Programs designed to facilitate adoption for households with limited digital literacy and long-term digital education can make a lasting difference. Digital literacy can also be encouraged through employer related tax incentives.

- Local governments should explain to the population why very high-capacity networks are to be installed and what benefits they will derive from these networks. Awareness can also be addressed through clear advertising rules.

- Policies can facilitate switching networks which implies civil works in the home, which generates varying degrees of consumer reluctance.

- As pricing is known to impact adoption, some countries are looking at regulated wholesale prices of copper and the price gap between that and wholesale prices of fibre.

- In markets where the dominant VHCN delivery model is through wholesale platforms, participation of national brands to this dynamic can make a significant difference in adoption.

- Any market where VHCN adoption has passed 50% should have plans in place to manage the gradual switching off of copper assets