Analyst GlobalData predicts an even higher figure: fixed broadband account penetration in APAC hit 18 percent at year-end 2021 and by 2026, this should be 21 percent. This development is driven by broadband network expansions and service adoption in countries such as India, Indonesia, the Philippines, and Thailand.

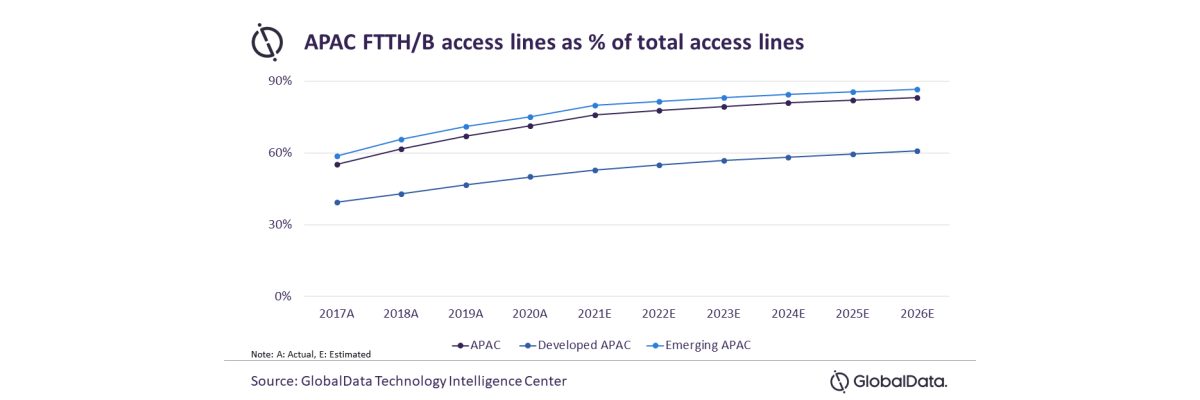

“Growth in the APAC fixed broadband market will be led by fibre broadband segment, which will see continued growth in the region,"

said Kantipudi Pradeepthi, telecom analyst at GlobalData.

"Fibre-optic access lines will account for a share of about 61 per cent of the total fixed access lines in the developed APAC region by 2026 while its share in the total fixed lines in the emerging APAC markets will be at a relatively higher 80 percent. ”

Fixed communications service revenue in the Asia Pacific (APAC) region is set to increase at a compound annual growth rate (CAGR) of 1.7 percent to reach $406.2 billion in 2026, the analyst claims.

China is at the forefront of the APAC fixed broadband services market, with 98% of all broadband subscriptions on fibre lines in the region at the end of 2021. The government’s Dual Gigabit Network Coordinated Development Action Plan aims to brings fibre-optic networks to over 200 million households by the end of 2023.What’s more, China is currently the world’s largest 5G market with an estimated 778 million 5G subscriptions in 2021. This number is projected to increase to 1.8 billion by the end of 2026. In 2021, Southeast Asia had the highest internet penetration in APAC (69 percent of the total population). The total online population across APAC reached 2.56 billion people.

Interestingly, ResearchAndMarkets’ Telecom Consulting Market Research Report 2022 stated that the demand for consulting services will grow fastest among APAC telcos, as an increasing number of people are being connected to the internet and demanding faster network speeds and low latency across the region.