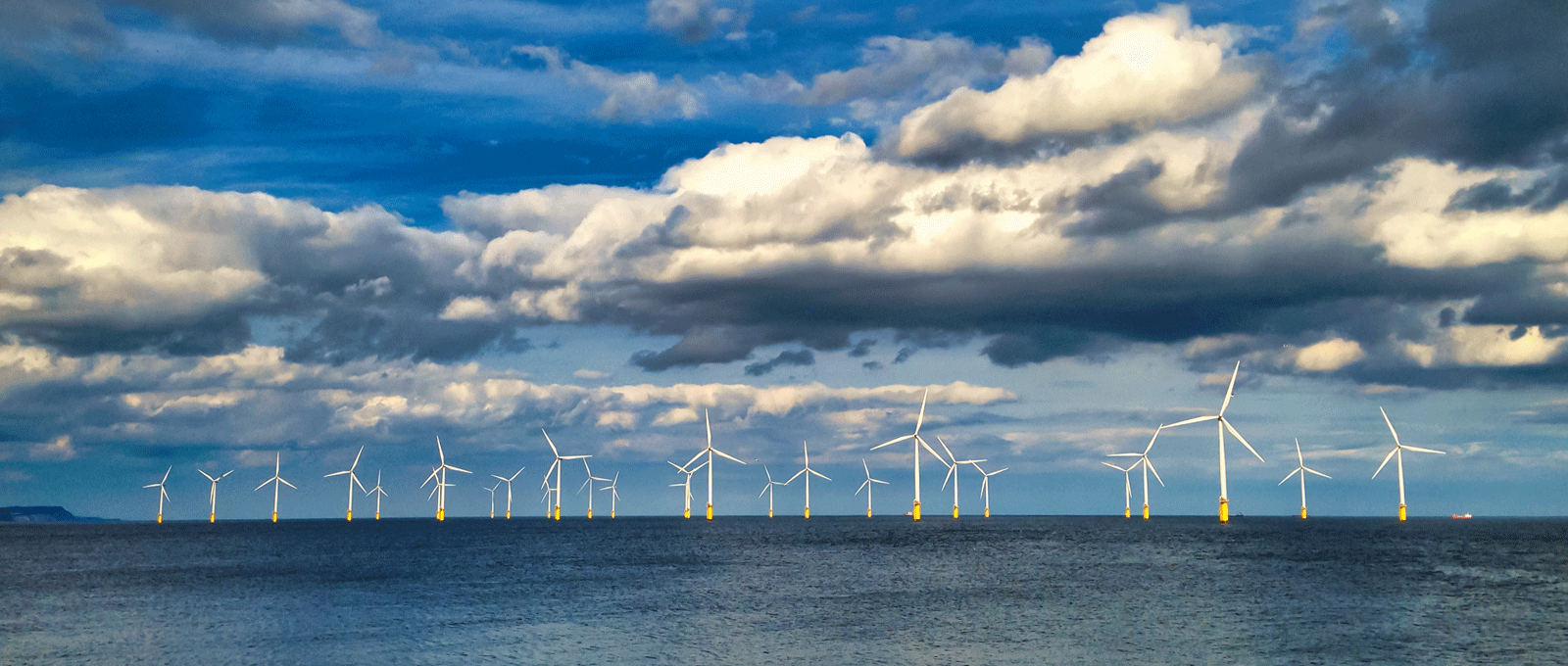

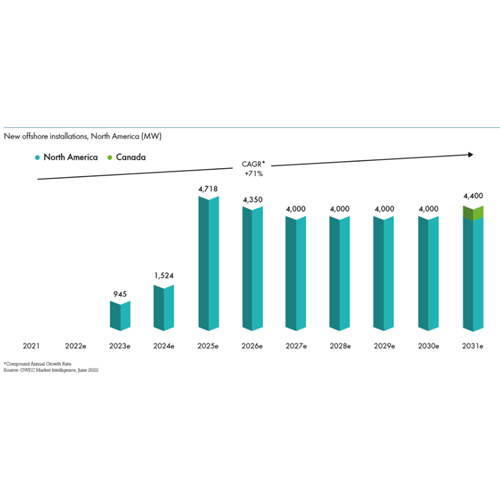

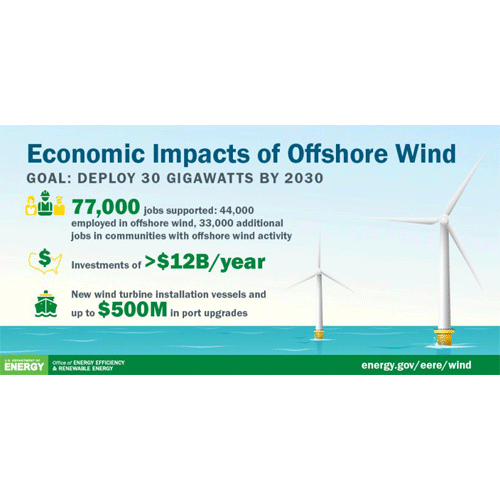

The US offshore wind market is gaining strong momentum in state and federal waters, with a 40 GW pipeline, according to the GWEC Market Intelligence global offshore wind database. Developers expect 18 GW of offshore wind to be online between 2023 and 2029.

According to the US Wind Energy Technologies Office, United States federal waters and the Great Lakes could yield over 4000 GW (13,500 TWh) annually. According to the U.S. Department of Energy Offshore Wind Market Report: 2022 Edition, the U.S. offshore wind energy project development and operational pipeline had reached potential generating capacity of 40,083 megawatts (MW) in May 2022.

This represents an increase of 13.5% over the previous year. To reduce per-megawatt costs, average offshore wind turbine capacity continues to grow.