Profitability at historic high

In the CEO’s opinion

MARCH 2017

Approaching ten years since Prysmian went public on the Milan Stock Exchange, we recorded an all-time high in terms of profitability in 2016. Adjusted EBITDA rose more than 14% to reach €711 million, with the target achieved at the high-end of the guidance range.

This is a proud moment for the Group, and CEO Valerio Battista reflects on his own pride at heading a record-breaking company. He notes, "We have closed 2016 on a note of profitability” and explains that the jump in profit was thanks to “the excellent sales performance in higher value-added businesses”, and “fostered by the company’s focus on operational efficiency and manufacturing footprint optimisation”.

Growth strategy accelerated

2016 was also a year for the acceleration of a growth strategy based upon investment in innovation and R&D, engaging talents, a commitment to sustainability and acquisition of strategic assets. Mr Battista now looks to 2017 as a year of “consolidation of market leadership and of further improvement of profitability”, namely in the Submarine cables business. He is also committed to continuing to rationalise the Group’s activities “with the objective of achieving projected cost efficiencies and greater competitiveness in all areas of business, and building on the achievements of 2016”.

Making the most of opportunities

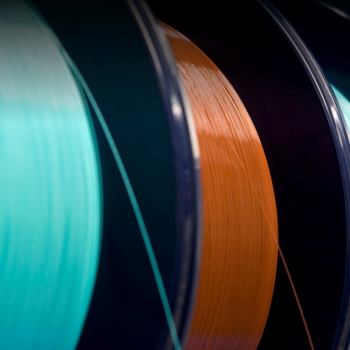

Innovation played an important role in achieving these impressive results. The technological innovations introduced by the Energy Projects business – such as the new 600 kV P-Laser cable and the 700 kV PPL cable – “represented milestones for the entire industry”, according to Mr Battista. He adds that significant progress has also been made in developing the Group’s project engineering and execution capabilities, “with a view to providing a turnkey service”, particularly thanks to the expansion of our fleet of cable-laying vessels. Driving the performance for the Telecom business was “the renewed competitiveness in fibre manufacturing and the creation of manufacturing centres of excellence”, that allowed the business to “make the most of opportunities in a growing market”.

An upbeat note for the future

Mr Battista predicts that the future outlook remains positive, both for Submarine cables and systems, “where we aim to win new power interconnection and offshore wind farm projects”, and for the Telecom business, “where optical cable demand remains high”. Strong sales performance and improved profitability have helped to further strengthen the financial structure, “with a better net financial position than expected”. He also points out a vision that goes somewhat further than purely achieving outstanding financial results. One that he summarises as follows: “Act in the interest of all stakeholders and make sustainable decisions, including decisions from a financial standpoint”.

A Public Company carries further responsibilities...

Being at the helm of an international public company carries responsibilities that go beyond its quarterly financial achievements. Prysmian can be defined as a truly public company as it has no majority or control shareholders – with only two investors exceeding the threshold of 2% - while our employees also can be counted in the equity ownership.

“Control is exercised not only on the basis of the number of shares, but also through results and the fact that all shareholders follow you”

Valerio Battista

Chief Executive Officer

... and can create value

Despite its widely held shares, the company’s management has remained stable since its initial listing in the Milan Stock Exchange in 2007. Being a Public Company also brings the risk of being at the mercy of external entities. But Mr Battista does not necessarily see this as a negative: “It is impossible to protect against a possible attempt to take over a company”, he explains. “If the interests of all stakeholders are respected, then the problem of sale to third parties is not an issue. A public tender offer would also create value”.

OIL & GAS

Viaggio al centro della Terra con Prysmian Oil & Gas

FAST TRACK PROJECT

Il futuro comincia a Calais, la nostra prima fabbrica 4.0

FT-ETNO SUMMIT 2017

Tracciare la via alla connettività di domani

TELECOMUNICAZIONI

Il nostro impegno a sostegno della banda ultralarga italiana

GRADUATE PROGRAM

Il benvenuto del CEO ai partecipanti a Build the Future

PEOPLE