The results for the first 9 months

of 2016, approved by Prysmian’s

Board of Directors, showed sales

organic growth in line with the

first half while margins rose in

almost all the businesses.

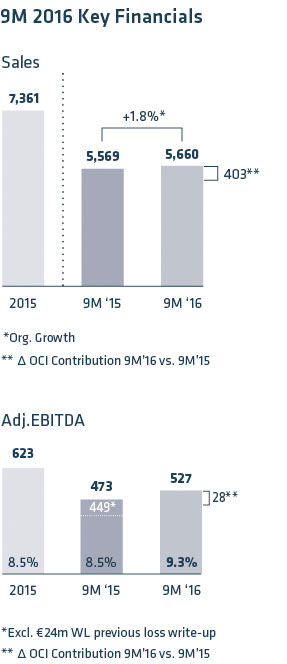

The results for the first 9 months of Prysmian

Group showed sales rising organically

by 1.8% to €5,660 million with project execution capability driving a 20.9% organic growth by Energy Projects while Telecom confirmed the positive organic trend with a 8.4%. Profitability increased in all businesses, except for Oil & Gas, and ADJ EBITDA climbed 11.5% to €527 million, with margin on sales at 9.3%.

CEO Valerio Battista stated that “our capability to execute the major power transmission projects in our portfolio and confirmation of the solid growth trend by Telecom have driven the nine-month results.” While sales has grown in line with the first half of the year, the Group posted another leap in profitability, with rising margins in almost all businesses except for Oil & Gas, still affected by the very poor market conditions. Among the winning factors, Mr. Battista mentioned the “insistent focus on reducing costs and the progress in rationalizing the manufacturing footprint”. The market trend was confirmed as solid for the strategic businesses of power transmission, interconnections, offshore windfarms and optical cables for broadband telecom networks. Mr. Battista said he expected the more cyclical businesses to gradually stabilise and Oil & Gas to experience continued difficulties. Based on these prospects, the Group confirmed the profitability targets for full year 2016, with ADJ EBITDA at the upper end of the range of €670-720 million.

Sales grew organically by 1.8% to €5,660 million driven by solid trends in the Telecom business and sound execution in Energy Projects, in line with H1.

Adjusted EBITDA amounted to € 527m, or 9.3% on Sales, with margin expansion in all businesses, with the exception of Oil&Gas.

Continued focus on cost efficiency with relevant progress in manufacturing footprint optimization.

Net Financial Position reported a balance of €1,017 million as of September 30 2016 compared to €955 million at 30 September 2015. Excluding the recent acquisition impact of OCI and GCDT it would have been €822 million.

Project execution drove

growth in submarine cables

while also high voltage

underground did well.

Offshore wind in Europe

expected to accelerate.

The Energy Projects Operating Segment saw sales jumping to €1,172 million, posting organic growth of 20.9% on the first nine months of 2015, while profitability also improved, with Adjusted EBITDA up 12.4% to €172 million and a margin on sales at 14.6% versus 15.4% (13% excluding the €24 million write-up related to the Western Link project).

Sales of Submarine Cables and Systems rose considerably, driven by progress in the execution of the important projects currently in the Group’s order book. Margins also much improved thanks to the focus on project management and to the enhancement of cable installation assets, making it possible to insource more of the installation operations. The outlook for 2016 is stable for power interconnections while an acceleration in offshore wind projects is expected.

Sales of High Voltage Underground business have performed particularly well, driven by the execution of the France- Italy interconnector and the execution of projects in North America and Asia Pacific. The medium term outlook is positive for markets in the Middle East, Asia Pacific and Central Europe. The underground and submarine cumulative power transmission order book stands high at €2,600 million.

The first nine months saw

weaker sales but better margins

for Trade & Installers while

Power Distribution improved

profitability with growth

slowing in Q3 as expected.

Within Industrial, Elevators

and Automotive were positive,

while a slowdown occurred for

Specialties & OEM.

Energy Products Operating Segment overall sales amounted to €3,398 million, posting negative year-on-year organic trend of 2.1%, with Oceania and certain Asian countries growing, Europe stable and a steep reduction in volumes in Brazil and Argentina. Adjusted EBITDA climbed 12.6% to €217 million, with the margin on sales improved to 6.4% from 5.7% in the nine months of 2015.

Sales of Energy & Infrastructure scored a negative organic growth of 1.9% to €2,300 million, of which €403 million contributed by Oman Cables Industry. Adjusted EBITDA climbed 25.3% to €123 million, of which €28 million from the additional contribution of fully consolidating Oman Cables Industry, with the margin on sales improving further to 5.4% from 4.5%.

The results for Trade & Installers showed a slight organic decline partly due to the decision to focus on a product and channel mix designed to protect profitability, which improved indeed. Positive performances were recorded in Northern Europe, while the important South American market, like APAC and Central-Southern Europe, continued to turn down.

Power Distribution confirmed the positive sales trend, even if weaker in the third-quarter as expected, with a general improvement in profitability. Most of the impetus came from Northern Europe, the Netherlands and APAC, while demand slowed in Germany and exchange rates had a negative impact in Argentina.

Industrial & Network Components sales decreased organically by 2.5% to €1,021 million, mainly due to the instability of investment demand in certain sectors. Adjusted EBITDA improved to €95 million from €92 million with margin on sales rising to 9.3% from 8.1%. Specialties & OEM reported a negative sales performance, while Elevators enjoyed a solid performance thanks to the increased market share in North America.

The Automotive business reported an increase in sales and a slight improvement in profitability, with APAC and Eastern Europe benefiting from the new manufacturing set-up. Sales of Network Components were slightly higher, with solid performance by High Voltage.

Umbilicals evolving in line with expectation reflecting

the framework agreement in Brazil while project phasing

impacted the core cable business. Focus on supply chain

optimization and effectiveness of manufacturing footprint.

The Oil & Gas Operating Segment sales came in at €225 million with a negative organic growth of -31.6% as the performance was hit hard by the oil price trend. Adjusted EBITDA fell to €9 million from €21 million with margin on sales at 4.1% from 6.2%.

The negative phasing of both onshore and offshore projects in the Core Oil & Gas Cables business resulted in a steep fall in volumes and drop in prices. Market conditions stay difficult and the Group confirms its focus on restructuring and optimising the manufacturing footprint, while continuing to rely on the greater competitiveness of its facilities in Asia. In the Subsea Umbilicals Risers and Flowlines (SURF) business, the performance of Umbilicals is evolving in line with expectations and reflects the renewed terms of the framework agreement in Brazil. The Group is continuing its efforts to optimise the supply chain and strengthen integration with key suppliers.

Downhole Technology results were in line as having benefited from the full integration of Gulf Coast Downhole Technologies, acquired in the second half of 2015.

Sales posted an organic growth of 8.4% driven by healthy

demand for optical fibre cables and for copper cables in Asia

Pacific, while profitability also improved.

The Telecom Operating Segment sales grew by 8.4% organically to €865 million, driven by healthy demand for optical fibre cables and by strong demand for copper cables in Asia Pacific. Adjusted EBITDA jumped 20.9% to €129 million, with margin on sales also improved to 14.9% from 12.6% in the same period of 2015.

The Telecom solutions business confirmed the positive performance of optical cables and fibre, with a solid trend in Australia, North America and France. The recovery of efficiency and competitiveness in fibre manufacturing has been reflected in a significant improvement in margins, accompanied by robust demand for copper cables in Asia Pacific.

Multimedia Solutions enjoyed a positive performance in Europe, also thanks to increased production capacity for copper data transmission cables.

The high value–added business of optical connectivity accessories performed well, triggered by the development of new FTTx networks that provide the last mile broadband, in Europe and particularly in France, Spain and the Netherlands.

The first nine months of 2016 witnessed a macro environment with mixed growth in Europe’s major

economies, partially eroded by the uncertainty generated by the British vote to leave the European

Union. In the United States growth remained stable but less intense than in 2015, while among

emerging economies China and Russia are showing signs of stabilising after the uncertainties seen

at the start of the year. The economic and political situation in Brazil remains challenging.

The Group’s expectations for FY 2016 is that demand in the cyclical businesses of building wires and medium voltage cables for utilities will be slightly lower with a general stabilisation in prices. Given the positive market environment for the Energy Projects, the Group expects both the Submarine and High Voltage underground businesses to improve their performance. The reduction of investments due to the low oil price is expected to adversely affect the Core Oil & Gas Cables business. In the Telecom, it is expected that the increased demand for optical fibre cables recorded in the first part of the year, will continue through to the end of 2016.

The Group is therefore confirming its forecast of Adjusted EBITDA for FY 2016 at upper end of the range €670-720 million, marking a considerable improvement from the €623 million reported in 2015. This forecast takes into account the current order book and the factors mentioned above, and reflects the expectations concerning full consolidation of Oman Cables Industry from 1 January 2016.

Market reaction to the first nine months of 2016 was positive, with the stock price rerating steadily after the release. Operating figures were broadly in line with expectations, although with a different mix of business. All brokers confirmed their recommendation and target price, except Equita, that increased its target price to €24.8/share from 24.5/share and Fidentiis, that raised its valuation range to €25-26/share from €23-24/share. Bank of America – Merrill Lynch confirmed its BUY rating despite a small negative revision of FY 2016 and FY 2017 estimates, expecting Prysmian to continue reporting some of the strongest and less volatile earnings of the sector. Morgan Stanley appreciated Prysmian as one of the most consistent performers in Cap Goods, having posted eight quarters of positive organic growth, while continuing margin improvement. Intermonte confirmed its neutral recommendation after the strong YTD stock performance and a full-looking valuation, predicting a better entry point into a high-quality story.